If you hold Bitcoin or other cryptocurrencies in Germany, and you’ve kept them for over a year, you might not owe a single euro in taxes when you sell. That’s not a rumor. It’s the law. Since 2025, Germany has made its 12-month crypto tax exemption clearer than ever, and it’s one of the most favorable rules in all of Europe. But here’s the catch: it only works if you get the details right. Miss the exact holding date by a few hours, mix your short-term and long-term coins in one wallet, or forget to report staking rewards, and you could end up paying thousands in taxes you didn’t have to.

How the 12-Month Rule Actually Works

Germany doesn’t treat Bitcoin like stocks or bonds. It calls it private money. That small label changes everything. When you buy Bitcoin, Ethereum, or even a stablecoin like USDT, the clock starts ticking the moment the transaction confirms on the blockchain. You need to hold it for exactly 365 days - not 360, not 370 - to qualify for full tax exemption. The German Federal Central Tax Office (BZSt) doesn’t care if you traded 10 times in that year. They only look at the acquisition date and the disposal date. If you bought 0.5 BTC on March 14, 2024, and sold it on March 15, 2025, you’re tax-free. If you sold it on March 14, 2025, at 11:59 PM, you still owe taxes. Every second counts.This rule applies to every crypto transaction: selling for euros, swapping for another coin, or even using Bitcoin to buy a laptop. The moment you dispose of it after less than a year, it’s taxable income. And there’s no partial exemption. If you made €1,200 in gains from a 6-month hold, you pay tax on the full €1,200 - not just the €200 over the threshold.

The €1,000 Short-Term Threshold - A Trap for Beginners

There’s a loophole that sounds like a gift: if your total crypto gains in a year are under €1,000, you don’t have to report them. Sounds great, right? But this isn’t a free pass. It’s a trap. Many people think they can trade small amounts all year and stay under the limit. They don’t realize that if they hit €1,001 in gains, the entire amount becomes taxable. Not just the extra euro. The whole €1,001.And here’s the kicker: this €1,000 limit hasn’t changed since January 2024, even though inflation has pushed prices up 6.2%. That means the same €1,000 threshold now covers less real value than it did in 2023. If you bought ETH at €2,000 and sold it at €2,800, that’s an €800 gain. Do that twice in a year, and you’re over the limit. No warnings. No grace period. Just a tax bill.

What Gets Taxed - And What Doesn’t

Not every crypto activity is treated the same. Here’s what’s taxable:- Selling crypto for euros or another currency

- Trading one crypto for another (e.g., BTC for ETH)

- Spending crypto on goods or services

- Receiving staking or mining rewards (taxed when received, unless held over 12 months)

- Earned crypto from freelance work or salaries

And here’s what’s not taxed:

- Buying crypto with euros

- Transferring crypto between your own wallets

- Donating crypto to a registered charity

- Receiving crypto as a gift from family (if under €20,000 annually)

Staking rewards are tricky. If you earn 0.05 ETH from staking on January 10, 2025, and sell it on January 11, 2026, you’re tax-free. But if you sell it on January 9, 2026, you pay income tax on the full value at the time you received it. The same applies to mining rewards and airdrops. The clock starts when you get them, not when you bought the coin that earned them.

Why FIFO Accounting Is Your Worst Enemy

Germany forces you to use FIFO - First In, First Out. That means when you sell, the tax office assumes you’re selling your oldest coins first. Sounds fair? Not always.Imagine you bought 1 BTC in 2021 for €20,000, then bought another 1 BTC in 2024 for €60,000. You hold both in the same wallet. In 2025, you sell 0.8 BTC for €70,000. Because of FIFO, the tax office says you sold the 2021 coin - so your gain is €50,000. Even though you only meant to sell the newer, more expensive one. You can’t pick which coins to sell. You can’t cherry-pick your losses. And if you mixed purchases from different exchanges, your records better be perfect.

This is why 68% of German crypto users who file taxes themselves use software like Koinly, BitcoinSteuer, or Blockpit. Manual tracking across multiple wallets and exchanges? Nearly impossible. One wrong timestamp, and your entire tax calculation collapses.

How to Avoid the Biggest Mistakes

Here’s what experienced German crypto holders do differently:- Use separate wallets - one for short-term trades, one for long-term holds. No mixing.

- Screenshot every transaction timestamp - from the exchange, from the blockchain explorer. Save them in a folder labeled by date and coin.

- Never assume your exchange’s report is accurate - many still don’t track staking or DeFi events correctly.

- Wait until day 366 to sell. Don’t count on the 365th day. Use a calendar app with a reminder.

- Don’t ignore small rewards - even €50 in staking adds up fast over a year.

One Reddit user, CryptoHODLer87, saved €8,450 in taxes by holding 1.2 BTC for 366 days. Another, DayTraderDE, lost €3,200 because he sold ETH 12 hours too early. It’s not about luck. It’s about precision.

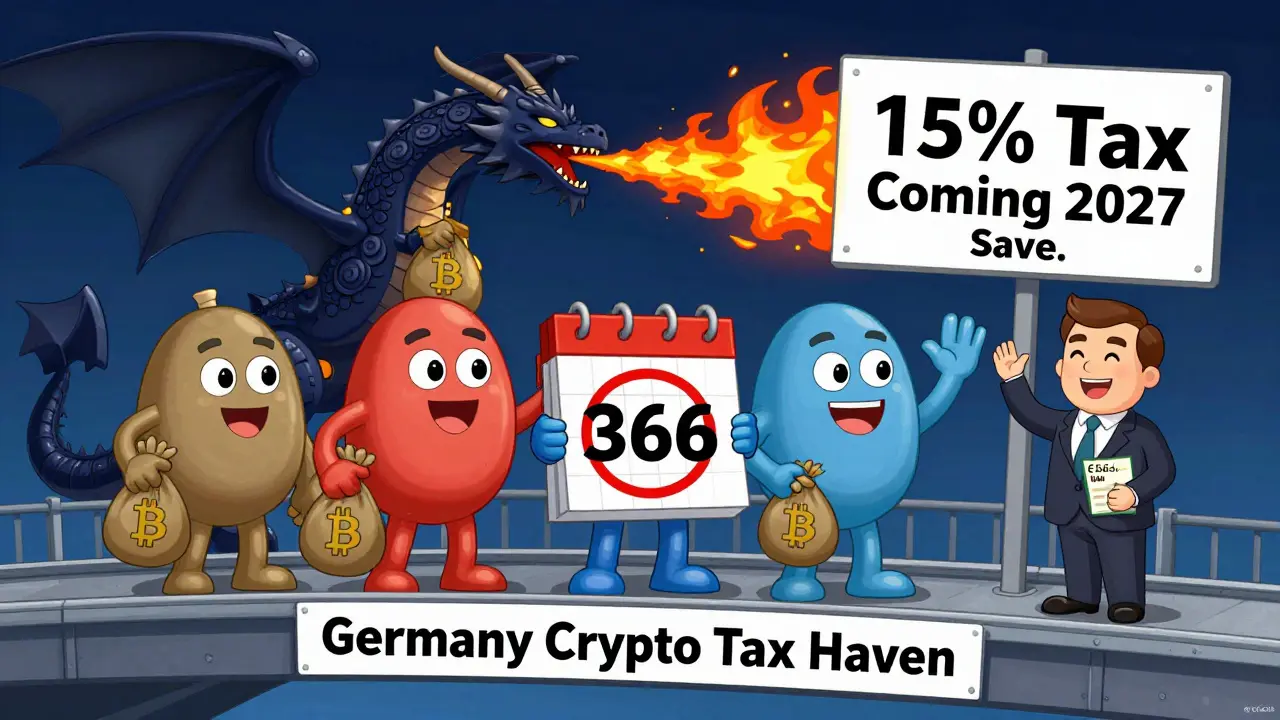

The EU Is Coming - And It Could End This

Germany’s rule is unique. Portugal used to have a better one (28-day exemption), but they changed it. Now Germany is the top dog in Europe for long-term holders. But that might not last.The EU’s DAC8 directive, launching in 2026, will force all member states to share crypto transaction data with tax authorities. By 2027, the EU Commission is pushing for a standardized 15% capital gains tax on all crypto held over 365 days. That would kill Germany’s 0% exemption. Industry analysts at Deloitte give it a 60% chance of passing. If it does, existing holdings might be grandfathered in - but new purchases after 2027 could be taxed.

Right now, Germany’s system is a sweet deal for buy-and-hold investors. 73% of German crypto owners hold assets longer than 12 months - not because they’re patient, but because they know the tax savings are real. But if you’re trading weekly, this system works against you. You’re stuck with high income tax rates (up to 47.5%) and no way to offset losses. The US lets you deduct $3,000 in losses each year. Germany? No. Zero. If you lose €5,000 on one trade and make €6,000 on another, you pay tax on the full €6,000.

How to File - And When

You file crypto taxes through the Elster online portal. Paper forms? Still allowed, but the BZSt actively discourages them. The portal’s crypto module has improved since 2023, but 61% of users still rely on third-party software to generate the data they need.The deadline? July 31 of the following year. But in 2024, it was pushed to September 30 due to system delays. Don’t count on that happening again. If you’re using software, export the BZSt-compliant report and upload it directly to Elster. If you’re doing it manually, you need to list every disposal, the acquisition date, the value in euros at both times, and the resulting gain or loss.

Most people who file for the first time spend 15-20 hours just learning how. 87% end up hiring a tax advisor - and it’s worth it. The average cost? €285 per year. That’s less than most people pay in taxes they didn’t have to.

Who Benefits the Most?

This system is built for one type of investor: the long-term holder. If you bought Bitcoin in 2021 and didn’t touch it until now, you’re sitting on a tax-free gain. If you’re a day trader, this is a nightmare. If you’re a freelancer paid in crypto, you need to track every payment and report it as income. If you’re earning staking rewards on multiple coins, you’re managing dozens of clocks.Statista shows 29.7% of Germans own crypto. That’s over 25 million people. And nearly 1 in 3 of them are holding for the tax break. That’s not speculation. That’s strategy. Germany didn’t just create a tax rule. It created a cultural behavior around crypto.

And it’s working. More than 18,500 foreigners moved to Germany in 2024 specifically because of the crypto tax exemption. They’re not just investors. They’re residents. They’re paying rent, buying groceries, using German healthcare. The rule isn’t just about money. It’s about attracting people.

Final Reality Check

Germany’s 12-month crypto tax exemption isn’t a loophole. It’s a deliberate policy. It rewards patience. It punishes recklessness. It doesn’t care if you’re rich or middle-class. It only cares about dates, numbers, and records.If you’re holding Bitcoin in Germany and you’re close to 365 days - don’t rush. Wait. Take the extra day. Take the extra hour. Take the extra minute. That’s not just smart. It’s the difference between keeping €10,000 and handing it to the tax office.

And if you’re thinking of starting? Buy once. Hold. Don’t trade. Let the clock run. That’s the only way to make this system work for you.

6 Comments

Chris O'Carroll

This is the most absurd thing I’ve ever seen. Germany lets you hold crypto for a year and then boom - tax-free? What is this, a socialist crypto utopia? Meanwhile in the US, I’m paying 30% on gains from a 3-day trade. Someone’s gotta explain why my country is so broken. I’m not mad, I’m just disappointed. 😭

Chidimma Okafor

What a profound and meticulously articulated policy framework! The German approach to cryptocurrency taxation is not merely fiscal-it is a cultural manifesto that honors patience, discipline, and long-term vision. In a world obsessed with instant gratification, this rule is a quiet revolution. One must admire the precision of the 365-day threshold; it is not arbitrary, but a sacred countdown to financial sovereignty. Let this be a beacon for nations still shackled by archaic capital gains paradigms. 🌍✨

ASHISH SINGH

They say it’s a tax exemption but let’s be real - this is all a distraction. The EU is already building a backdoor to track every single satoshi you ever touched. DAC8? That’s not regulation, that’s a digital leash. And don’t tell me about FIFO accounting - they’re using blockchain data to build behavioral profiles. Next thing you know, they’ll flag you as a ‘crypto risk’ and deny you a mortgage. This isn’t freedom. It’s a honey trap. The Germans know what’s coming. They’re just letting you enjoy the last free meal before the lights go out.

Vinod Dalavai

Man, I love how this post breaks it all down. I’ve been holding my BTC since 2022 and was scared to sell because I didn’t know the rules. Now I’m just waiting for March 15th like it’s Christmas 😊. Also, separate wallets? Genius. I just moved my short-term stuff to a new address - felt like organizing my closet. Took me 20 mins. So simple. Thanks for the clarity, this post saved me from a tax nightmare 💪

Callan Burdett

Germany just turned crypto into a lifestyle sport. You don’t just buy Bitcoin here - you train for it. You plan your sales like a ninja. You screenshot timestamps like they’re holy relics. And if you mess up? You pay. No second chances. This isn’t finance. It’s a hardcore reality show where the prize is your own money. I’m jealous. I’d move there tomorrow if I could. 🇩🇪🔥

Nishakar Rath

This whole thing is a scam designed to make people think they’re smart for holding long term when really the government just wants you to stop trading so they can control the market better. Who even tracks staking rewards across 7 wallets and 3 exchanges? Nobody. They know that. They’re just waiting for you to slip up so they can fine you. And don’t get me started on FIFO - it’s rigged against you. The system is built to catch you not help you. You think you’re winning? You’re just being played