Bitcoin doesn’t print money. It doesn’t have a central bank. Instead, it has a countdown - a clock built into its code that cuts new Bitcoin in half every four years. This isn’t a guess. It’s not a policy change. It’s a rule written in stone by Satoshi Nakamoto in 2009. And every time it hits, the market reacts. Not always the same way. But always meaningfully.

What Exactly Is a Bitcoin Halving?

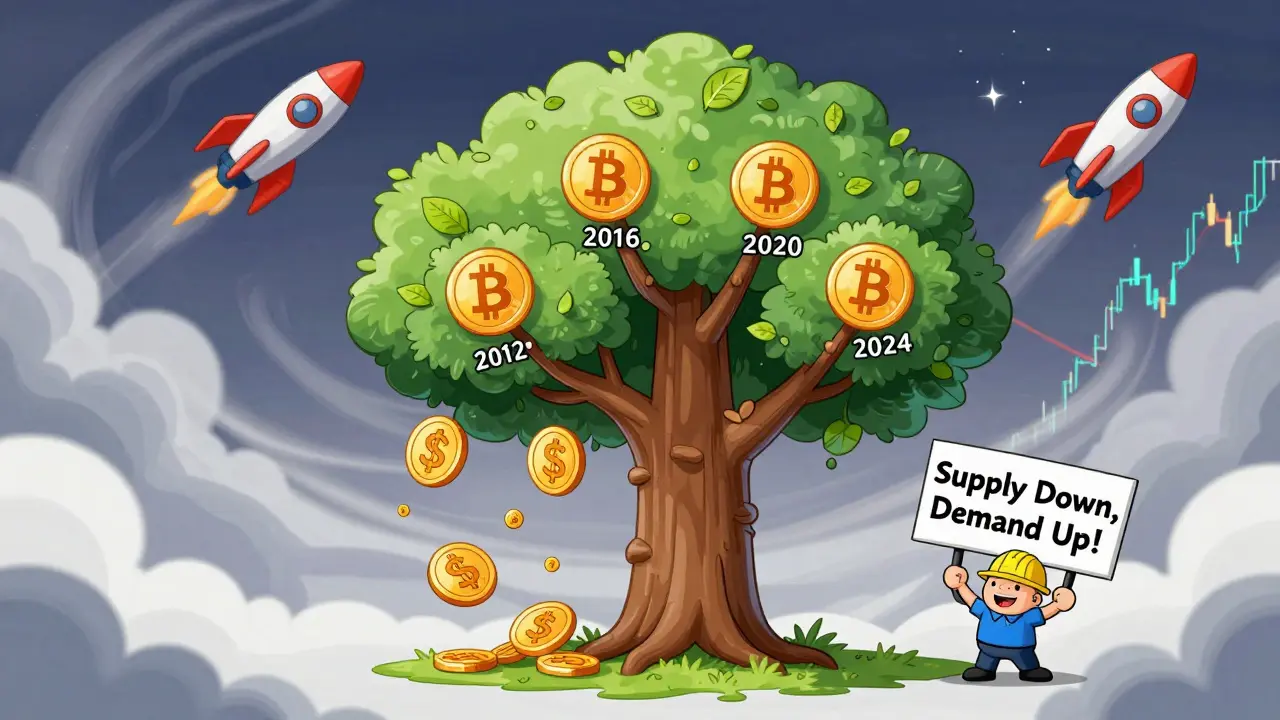

A Bitcoin halving is when the reward for mining a new block drops by 50%. It’s built into the protocol to happen every 210,000 blocks. With blocks mined roughly every 10 minutes, that’s about every four years. The first halving cut the reward from 50 BTC to 25 BTC. The second cut it to 12.5. The third to 6.25. And the most recent one, in April 2024, dropped it to 3.125 BTC per block.

This isn’t just a technical detail. It’s monetary policy. Every halving reduces the rate at which new Bitcoin enters circulation. That means less inflation. More scarcity. And over time, that scarcity becomes the backbone of Bitcoin’s value. By the time the last Bitcoin is mined around 2140, no new coins will be created. Miners will survive only on transaction fees - a system designed to keep the network secure without relying on inflation.

The First Halving: November 28, 2012

In 2012, Bitcoin was still a curiosity. Few people owned it. Fewer understood it. The price was around $10.59 when the halving happened. Within 180 days, it had jumped to $126.24 - a 1,092% increase.

Was the halving the reason? Maybe. But the market was tiny. Liquidity was low. A small surge in demand could swing prices wildly. Still, this was the first real-world test of Bitcoin’s scarcity model. It proved the halving wasn’t just theory. It had real economic effects. Early adopters who held through the event saw their holdings multiply. And the world started paying attention.

The Second Halving: July 9, 2016

By 2016, Bitcoin had grown up. Exchanges were more stable. Media coverage had increased. Institutional interest was starting to peek through. The reward dropped from 25 BTC to 12.5 BTC. And the price? It didn’t jump right away. But over the next 12 months, it climbed steadily - hitting $1,002.92 by the end of 2017.

This wasn’t just a halving. It was the start of a bull run that brought Bitcoin into the mainstream. The halving created supply pressure. But what really pushed prices higher was growing belief. People started seeing Bitcoin as digital gold - a hedge against traditional financial systems. The 2016 halving didn’t cause the bull market. But it set the stage for it.

The Third Halving: May 11, 2020

2020 was chaos. The pandemic shut down economies. Central banks printed trillions. Interest rates hit zero. People scrambled for anything that couldn’t be inflated away.

Bitcoin’s halving came just as global money printing exploded. The reward dropped from 12.5 BTC to 6.25 BTC. And within 180 days, Bitcoin surged to $14,849.09.

This time, the story wasn’t just about scarcity. It was about macroeconomics. Bitcoin became a safe-haven asset - not because it was stable, but because it was predictable. While governments printed money, Bitcoin’s supply was locked in code. Investors saw that. Hedge funds started buying. Corporations like MicroStrategy began adding Bitcoin to their balance sheets. The halving didn’t cause the rally - but it gave people a reason to believe.

The Fourth Halving: April 19-20, 2024

The latest halving was the biggest in terms of market impact. Bitcoin’s price was over $60,000 before it happened. The reward dropped from 6.25 BTC to 3.125 BTC - a 50% cut in a market worth over $1 trillion.

For the first time, the halving happened in a fully mature market. ETFs were approved. Retail investors had apps on their phones. Miners operated like factories. The supply shock was massive, but the demand was massive too.

Within six months, Bitcoin hit $73,000. Then $78,000. By late 2025, it briefly touched $100,000. Was it the halving? It helped. But this time, the catalyst was institutional adoption, regulatory clarity, and global uncertainty. The halving didn’t create the trend - it amplified it.

How Halvings Affect Miners

Every halving hits miners hard. Their block reward is cut in half. Profit margins shrink. Less efficient miners - those using old hardware or cheap electricity - get squeezed out. After the 2024 halving, Bitcoin’s network hash rate dropped by nearly 20% in the first month. But it recovered within three months as only the strongest operators remained.

This is intentional. Bitcoin’s design forces consolidation. The network becomes more secure over time because only the most efficient miners survive. And those miners have a vested interest in Bitcoin’s long-term success - because their revenue depends on it.

What About Price? Does Halving Guarantee a Rally?

No. And that’s important to understand.

Halvings create supply-side pressure. Less new Bitcoin means fewer sellers. But price is driven by demand. If no one wants to buy, the price won’t rise - even with a halving.

Look at the data: The 2012 halving led to a huge price surge. The 2016 halving led to a slower, steadier climb. The 2020 halving happened during global panic - which drove demand. The 2024 halving happened after years of institutional buildup.

Each halving occurs in a different context. The market’s maturity, macroeconomic conditions, and adoption levels change. So while halvings are predictable, price reactions are not. They’re the result of many forces - not just supply.

What’s Next? The 2028 Halving

The next halving is projected for March 26, 2028. The block reward will drop from 3.125 BTC to 1.5625 BTC. By then, Bitcoin will be 19 years old. Over 99% of all Bitcoin will have been mined.

At that point, the supply shock will be smaller in percentage terms - but the market will be vastly larger. The impact on price will depend on how much demand has grown since 2024. Will Bitcoin be a global reserve asset? Will governments accept it? Will miners still be profitable with only transaction fees?

The halving doesn’t answer those questions. But it forces them into the open.

Why This Matters Beyond Bitcoin

Bitcoin’s halving is more than a technical event. It’s a real-world experiment in sound money. No central bank controls it. No politician can change it. It’s automatic, transparent, and predictable.

That’s why economists, investors, and technologists watch it closely. It’s proof that a decentralized system can enforce scarcity without trust. That’s something no fiat currency has ever done.

Bitcoin’s value isn’t built on hype. It’s built on code. And that code has held for 15 years - through wars, crashes, bans, and booms. The halving is its heartbeat. And every time it ticks, the world gets a little more convinced that digital scarcity is real.

9 Comments

Mandy McDonald Hodge

omg this post made me cry 😭 i just bought my first 0.02 btc last year and now i’m literally watching the halving happen in real time... i feel like i’m part of something bigger than money. thank you for writing this.

Bruce Morrison

The halving isn’t magic it’s math. Less supply plus growing demand equals higher price. Simple. No mysticism needed. Just follow the numbers.

Andrew Prince

While it is undeniably compelling to observe the algorithmic reduction in block rewards as a deterministic mechanism for enforcing scarcity within a decentralized monetary framework, one must not conflate this technical artifact with intrinsic value creation. The price action following each halving event is, in fact, a function of macroeconomic liquidity conditions, institutional capital allocation paradigms, and psychological momentum-none of which are causally attributable to the halving itself. To ascribe price increases to the halving is to commit the post hoc ergo propter hoc fallacy, a logical error that has plagued crypto discourse since its inception.

Jordan Fowles

It’s funny how we treat halvings like prophecy. The code doesn’t care if we cheer or cry. It just runs. And yet, here we are-humans projecting meaning onto a machine. Maybe that’s the real miracle. Not the scarcity. But the fact that millions of strangers, across continents, all believe in the same countdown. That’s trust without a face.

Steve Williams

This is a beautifully articulated analysis. The concept of digital scarcity is revolutionary, especially for nations with unstable currencies. In Nigeria, where inflation erodes savings daily, Bitcoin’s fixed supply is not speculative-it is survival. Thank you for highlighting the miner consolidation effect; it underscores the network’s resilience.

nayan keshari

Halving my ass. Bitcoin went up because the fed printed money, not because some code cuts rewards. You guys act like this is alchemy. It’s just casino economics with a blockchain sticker on it.

Johnny Delirious

The 2024 halving represents the most significant inflection point in monetary history since the abandonment of the gold standard. The convergence of institutional adoption, regulatory clarity, and algorithmic scarcity has created an unprecedented convergence of capital flows. This is not speculation. It is the birth of a new monetary paradigm.

Bianca Martins

I remember when BTC was $12 and my cousin laughed at me for buying 0.1. Now he’s asking how to set up a wallet. 🤭 The halving didn’t make Bitcoin valuable-it just made people finally pay attention. Also, miners getting squeezed? Yeah, that’s the system working. Weak hands get filtered out. Strong hands keep going. That’s how you build something that lasts.

alvin mislang

You people are naive. This isn’t money. It’s a cult. The halving is just the latest ritual to keep the sheep believing. And don’t even get me started on those who think miners are ‘secure’-they’re just desperate capitalists clinging to a dying subsidy. 🙄