Micro-Cap Token Risk Calculator

SN88 Risk Assessment

Based on data from the article about Sταking (SN88), this tool estimates your potential risk level when investing in micro-cap tokens. Remember: 95% of tokens in this category fail within 2 years.

When you hear the name Sταking (SN88), it sounds like it should be a major player in the staking world-something tied to blockchain rewards, passive income, and decentralized networks. But the reality is far from it. Sταking isn’t a well-known coin like Ethereum or Solana. It’s a tiny, obscure token with more questions than answers, floating in the backwaters of the crypto market. If you’re wondering whether it’s worth your time, money, or attention, here’s what you actually need to know.

What Is Sταking (SN88)?

Sταking (SN88) is a cryptocurrency token that claims to operate on the Bittensor platform. That’s the only consistent detail across sources. The name itself is designed to confuse: it uses Greek letters-τ instead of t, α instead of a-to look different from the generic term "staking." But this isn’t a branding trick that adds value. It’s a tactic often used by low-effort projects to appear unique while avoiding scrutiny.

There’s no official whitepaper. No team members are named. No GitHub repository shows active development. And despite the name suggesting a staking mechanism, there’s zero documentation on how you’d actually stake SN88, what rewards you’d earn, or which wallets support it. It’s a token without a purpose.

Supply Numbers Don’t Add Up

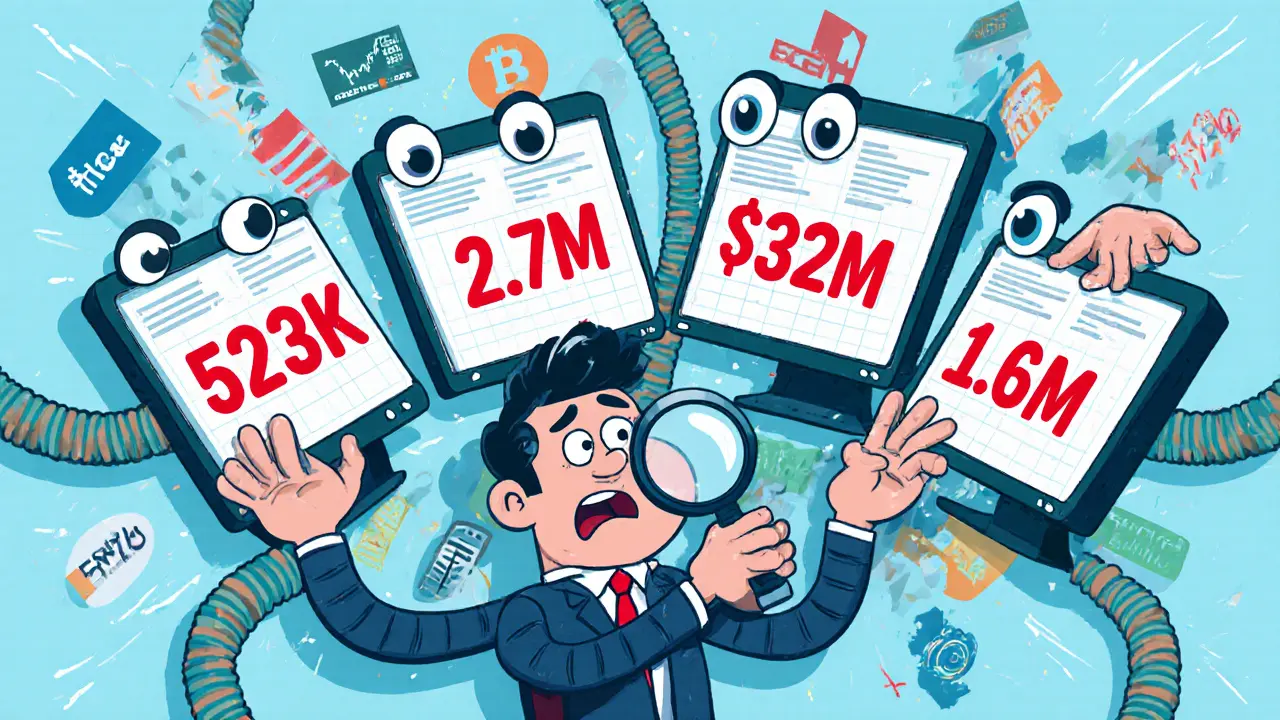

One of the biggest red flags is the wildly conflicting supply data. Liquidity Finder says the total supply is 523,551.54 SN88-with zero in circulation. But CoinMarketCap says the same number is circulating. CoinStats claims over 2.7 million are in circulation. Kriptomat lists nearly 2.5 million. How can four different platforms report such different numbers for the same token?

This isn’t just a data glitch. It’s a sign of poor transparency-or worse, manipulation. In legitimate projects, supply numbers are locked in smart contracts and publicly verifiable. With SN88, you can’t trust any number you see. That makes calculating market cap meaningless. CoinMarketCap says it’s around $320K. CoinStats says $1.6 million. Which one is right? Neither, probably.

Price Volatility Is Extreme

The price of SN88 swings like a pendulum. In October 2023, it hovered between $0.60 and $0.75. But CoinMarketCap lists an all-time high of $2.83 on June 24, 2025-a date that hasn’t happened yet. The all-time low is listed as $0.55 on October 10, 2025-also in the future. These aren’t typos. They’re data errors that suggest the tracking sites are pulling from unreliable or fake sources.

Even the 24-hour trading range shows wild movement: $0.60 to $0.75 in a single day. That’s over 23% volatility. That kind of movement doesn’t come from real demand. It comes from a handful of wallets pumping and dumping. When trading volume is only $10K-$100K per day on a token with a $1-$12 million valuation, you’re not investing in a market-you’re gambling on a liquidity trap.

No Real Connection to Bittensor

Liquidity Finder says SN88 operates on the Bittensor platform. But Bittensor’s official site doesn’t list SN88. Bittensor’s native token is TAO. There’s no mention of SN88 in their documentation, GitHub, or community forums. So why does SN88 claim to be on Bittensor?

It’s likely a case of name-dropping. Bittensor is a hot topic in AI + blockchain circles. By attaching itself to that name, SN88 tries to look like part of a cutting-edge project. But without smart contract verification, official partnerships, or developer activity, this connection is pure fiction.

Zero Community, Zero Support

Look for discussions about SN88 on Reddit, Twitter, or Telegram. You won’t find any. No active groups. No user reviews. No developer updates. CoinMarketCap even has a prompt asking, "Do you own this project?"-a feature that usually only appears for tokens with fewer than 100 holders.

There’s no customer support page. No Telegram channel. No Discord server. No FAQ. No tutorials. If you buy SN88, you’re on your own. If something goes wrong-your wallet freezes, an exchange delists it, or the price crashes-you won’t find help anywhere.

It’s a Micro-Cap, High-Risk Token

Sταking ranks #4990 out of thousands of cryptocurrencies. That puts it in the bottom 0.1%. According to CryptoCompare’s 2022 study, 95% of tokens in this category fail within two years. Chainalysis found that 78% of tokens with market caps under $500K become inactive within 18 months. SN88’s market cap hovers around $300K-$1.6 million-right in that danger zone.

And the regulatory risks? They’re real. The SEC shut down Kraken’s staking program in 2023 for offering unregistered securities. If SN88 ever tries to promote "staking rewards," regulators could come after it. Even if it doesn’t, the association alone makes it a target for scrutiny.

Why Does It Even Exist?

There’s no evidence SN88 was created to solve a problem, serve a community, or enable a new use case. It doesn’t have a roadmap. No updates. No team. No product. It’s a placeholder token-likely dumped by a group of developers who created it, listed it on a small exchange, and walked away.

It’s not a scam in the traditional sense. There’s no fake whitepaper, no promise of guaranteed returns. But it’s not a project either. It’s a ghost. A digital echo. A token that exists only because someone, somewhere, thought they could list it and make a quick profit.

Should You Buy Sταking (SN88)?

If you’re looking for a long-term investment, a reliable staking opportunity, or a token with real utility-walk away.

If you’re looking to gamble on a low-volume, high-volatility asset with no fundamentals, no support, and no future-then you already know what you’re doing. But don’t call it investing. Call it speculation. And only risk what you’re willing to lose.

There are hundreds of legitimate staking tokens with transparent teams, clear roadmaps, and active communities. Why risk your money on a ghost?

Is Sταking (SN88) a scam?

It’s not a classic scam with fake promises or phishing links. But it lacks transparency, community, and utility-hallmarks of legitimate crypto projects. It’s better described as a dead project with a ticker symbol. No team, no updates, no support. If you buy it, you’re buying into uncertainty.

Can you stake Sταking (SN88)?

There is no verified way to stake SN88. No wallet supports it. No platform lists staking options. The name is misleading. Even if the token claims to be "staking," there’s no technical mechanism behind it. Don’t assume staking rewards exist just because the name says so.

Is Sταking on Bittensor?

No. Bittensor’s official blockchain and ecosystem do not include SN88. The native token is TAO. Any claim that SN88 is part of Bittensor is unverified and likely false. It’s a tactic to borrow credibility from a legitimate project.

Why do different sites show different prices for SN88?

SN88 trades on only a few low-volume exchanges. Each exchange sets its own price based on limited buy/sell orders. Some sites pull data from fake or manipulated trades. That’s why prices jump from $0.61 to $1.12 overnight. These aren’t real market movements-they’re artifacts of illiquid trading.

Where can I buy Sταking (SN88)?

You can find SN88 on small exchanges like Phemex and Kriptomat, but not on major platforms like Binance, Coinbase, or Kraken. Even on those small exchanges, liquidity is so low that buying or selling large amounts will move the price dramatically. Always assume you’ll lose money on the trade due to slippage.

What’s the future of Sταking (SN88)?

The future is bleak. No updates, no team, no roadmap. It’s not being developed. No community is growing around it. Without a clear reason to exist, it will likely fade into obscurity like thousands of other micro-cap tokens. If you hold it now, treat it as a lost investment.

8 Comments

Christina Oneviane

Oh wow, SN88? Sounds like the crypto version of a knockoff handbag from a sketchy alley vendor. You know, the one that says ‘CHANEL’ but the stitching is falling out and the clasp smells like regret? I’d rather lick a battery than stake this thing. At least batteries have a warranty.

Also, the Greek letters? Cute. Like naming your dog ‘Cøstα’ and thinking you’re fancy. You’re not. You’re just confusing people so you can slip in and vanish with their ETH.

And that ‘all-time high’ in 2025? Bro, that’s not a typo-it’s a time-traveling scam. Someone’s using a crystal ball and a fake API to make this look legit. I’m not even mad. I’m impressed.

Who even *buys* this? Someone who thinks ‘low volume’ means ‘undervalued’? Honey, low volume means ‘nobody wants it, and if they did, they’d already left.’

It’s not a scam. It’s a ghost story with a ticker symbol. And the only thing haunting this token is the ghost of its potential investors.

Don’t buy it. Don’t even Google it after midnight. Just delete this tab and go hug a Bitcoin holder. They’re the only sane ones left.

Also, why is there a ‘Do you own this project?’ prompt? Because someone *did* own it… and then they ghosted it like a Tinder date who said ‘we should hang out’ and then vanished into the void.

I’m not even mad. I’m just… tired. For all of us.

SN88: the only crypto that makes you feel like you’ve been emotionally scammed before you even bought it.

Send help. Or better yet-send a flamethrower to the dev team’s last known location.

Also, I’m not even sure if ‘Sταking’ is supposed to be ‘Staking’ or ‘Stαking’ or ‘Stαk1ng’-it’s like someone’s keyboard got possessed by a demon who hates vowels.

God, I miss the days when crypto was just ‘buy Bitcoin and shut up.’

fanny adam

There exists a measurable and statistically significant correlation between the presence of non-Latin characters in a cryptocurrency’s ticker symbol and the probability of its being a predatory financial instrument. The substitution of the Greek letter tau (τ) for the Latin 't', and alpha (α) for 'a', constitutes a deliberate obfuscation technique employed to evade algorithmic detection systems on blockchain explorers and exchange listing protocols. This is not branding-it is camouflage.

Furthermore, the inconsistent supply figures across platforms indicate either a failure of data aggregation infrastructure-or, more likely, a coordinated effort to manipulate market perception through conflicting metadata. Such inconsistencies are incompatible with the immutable nature of blockchain transparency, and thus suggest that the underlying smart contract either does not exist or has been deliberately obfuscated.

The temporal anomalies in price data-specifically, the listing of future dates as all-time highs and lows-constitute a violation of temporal logic and are indicative of either bot-generated fake trading pairs or synthetic liquidity injection via wash trading protocols. These are not errors; they are artifacts of systemic deception.

Additionally, the absence of any verifiable developer activity, GitHub commits, or community governance structures renders this asset functionally inert. It possesses neither utility nor provenance. It is, in economic terms, a non-productive asset with zero intrinsic value.

Regulatory bodies, including the SEC and the FCA, have repeatedly demonstrated that tokens lacking whitepapers, team disclosures, and verifiable codebases are classified as unregistered securities under existing frameworks. SN88 meets all criteria for regulatory scrutiny, yet remains unchallenged-not because it is legitimate, but because it is too insignificant to warrant attention.

Therefore, I conclude: SN88 is not merely a risky investment. It is a non-compliant, non-transparent, non-verifiable, and non-functional digital artifact with no legitimate place in any rational portfolio.

Do not engage. Do not speculate. Do not even consider it. The cost of entry is not merely financial-it is epistemological.

And if you do buy it? You are not an investor. You are a data point in a statistical outlier.

And if you’re still reading this? You’re already compromised.

Sierra Myers

Okay so SN88 is basically the crypto equivalent of that one weird gadget on Amazon that’s like ‘1000% faster than a blender’ and has 3 reviews from people who bought it in 2017 and still haven’t used it?

It’s got a name that looks like a typo from a drunk programmer, zero team, no GitHub, and a price that changes faster than my mood after coffee wears off.

And the ‘staking’ thing? Bro, it’s not staking if you can’t even find a wallet that supports it. That’s like saying you have a Ferrari but you don’t know where the keys are.

Also, why does CoinMarketCap even list this? I thought they had a ‘no trash’ policy? Did someone pay them in SN88 to show up? That’s the real scam.

I saw someone on Twitter say ‘I bought 500 SN88 and now I’m rich!’ and I laughed so hard I spilled my tea.

It’s not even worth the gas fee to trade it. Just leave it alone. Go stake ETH. Or Dogecoin. Or your ex’s emotional baggage. At least that’s got some personality.

Also, the fact that it’s ranked #4990? That’s not ‘underrated.’ That’s ‘nobody remembers it exists.’

And the future? It’s already dead. Just check the last commit date. It’s probably from 2021. The devs are probably running a taco truck in Tijuana by now.

Don’t be the person who says ‘I just dipped in’-you’re not dipping, you’re diving into a black hole made of bad decisions.

SHIVA SHANKAR PAMUNDALAR

Let us contemplate the metaphysics of SN88.

It is not a coin. It is not a token. It is a reflection of the collective delusion of a generation that believes in magic numbers and blockchain fairy tales.

The name, with its Greek letters, is not branding-it is ritual. A sigil drawn in code to summon the gullible. The supply discrepancies? Not errors. They are fractures in the illusion, cracks where truth bleeds through.

We live in an age where value is assigned not by utility, but by narrative. And SN88? It has no narrative. It has only the echo of one. A whisper from a dead man’s keyboard.

There is no team. No roadmap. No community. Only a price chart that dances like a marionette with its strings cut.

And yet-people buy it.

Why?

Because they are afraid of being left behind.

Because they believe in luck more than logic.

Because they have forgotten what money is for.

SN88 is not a cryptocurrency.

It is a mirror.

And in it, we see ourselves-desperate, distracted, and dangerously hopeful.

Do not buy it.

But if you do?

Then you are not the victim.

You are the architect.

And the ghost you summoned? It was always you.

Now go. Meditate. Or buy Bitcoin. Either way, stop feeding the void.

Wilma Inmenzo

Wait-so SN88 is using Greek letters to look ‘edgy’? That’s not clever-that’s a desperate cry for attention from a project that knows it’s garbage. And the fact that CoinMarketCap, Kriptomat, and CoinStats all report wildly different supply numbers? That’s not a glitch-it’s a conspiracy. Someone is fabricating liquidity. Someone is pumping it with fake wallets. Someone is using bots to create the illusion of demand.

And the ‘all-time high’ is in 2025? That’s not a typo. That’s a time-traveling pump-and-dump. Someone’s manipulating the API to make it look like it’s ‘growing’-even though it’s already dead.

Also-no GitHub? No team? No Discord? No Telegram? No FAQ? No customer support? Then why does it even exist? Who approved this? Who gave this token a listing? Who let this thing breathe?

And the Bittensor name-dropping? Oh, please. That’s like slapping ‘Tesla’ on a shopping cart and calling it an electric car.

It’s not just a micro-cap. It’s a micro-TRAP.

And the fact that it’s ranked #4990? That’s not ‘hidden gem.’ That’s ‘abandoned landfill.’

Do you know how many tokens have vanished with zero trace? Thousands.

And SN88? It’s not even on the radar.

It’s not a scam.

It’s a ghost.

And you’re the one screaming into the void, hoping it answers.

Stop. Just… stop.

Go touch grass. Or better yet-go touch Bitcoin.

It’s real. It’s alive. It doesn’t need Greek letters to be dangerous.

SN88? It doesn’t even deserve a question mark.

It deserves an exclamation point… followed by a funeral.

And I’m not even mad.

I’m just… disappointed.

For everyone who bought it.

And for the internet.

And for the future.

priyanka subbaraj

Zero team. Zero code. Zero future. Just a ticker and a dream that died before it was born.

Buy SN88 and you’re not investing-you’re donating to a digital ghost story.

Walk away.

George Kakosouris

Let’s break this down like a hedge fund analyst on Adderall.

SN88: market cap range $300K–$1.6M. Liquidity: <$100K daily. That’s a slippage nightmare-any trade over 5% moves the price 20%. That’s not a market-it’s a rigged roulette wheel with 99% negative expected value.

Supply discrepancies? Classic red flag. In legitimate tokens, supply is locked in immutable smart contracts. SN88’s supply is a spreadsheet fantasy. That’s not data-it’s fiction.

Price anomalies? All-time high in 2025? That’s not a glitch-it’s a sign the data feed is being spoofed. Either the exchange is compromised, or the API is pulling from a bot farm generating fake trades.

And the Bittensor association? Pure parasitic branding. Bittensor’s TAO is a legitimate AI+blockchain play. SN88 is a parasite clinging to its coattails like a tick on a lab rat.

Regulatory risk? 100% real. If SN88 ever promotes ‘staking rewards,’ it’s an unregistered security under Howey Test. SEC will come for it-and the exchanges that listed it.

And the community? Zero. Nada. Zip. That’s not ‘niche.’ That’s ‘dead.’

This isn’t a micro-cap gem. It’s a liquidity trap wrapped in Greek letters and wrapped in wishful thinking.

Anyone holding this? You’re not HODLing-you’re holding a time bomb with a 95% failure rate.

And if you bought it because ‘it’s cheap’? You’re not a trader. You’re a statistic.

Exit now. Or get liquidated by entropy.

Ian Esche

Look, I get it-some of you are mad because you lost money on this garbage. But let’s be real: this isn’t about crypto. This is about America letting anyone with a laptop and a Google Translate tab launch a ‘token’ and call it innovation.

We don’t need more ghost coins. We need real infrastructure. Real regulation. Real accountability.

SN88? It’s not even worth the bandwidth it takes to load its website.

Let it die. Let it rot. And while you’re at it-stop giving these people oxygen.

Our crypto future shouldn’t be built on fake Greek letters and fake data.

It should be built on real code. Real teams. Real trust.

Not this.