What if you could buy Bitcoin, hold it for a year, and then sell it for a 10x profit - and pay zero in taxes? In Germany, that’s not a fantasy. It’s the law.

How Germany Lets You Keep All Your Crypto Gains

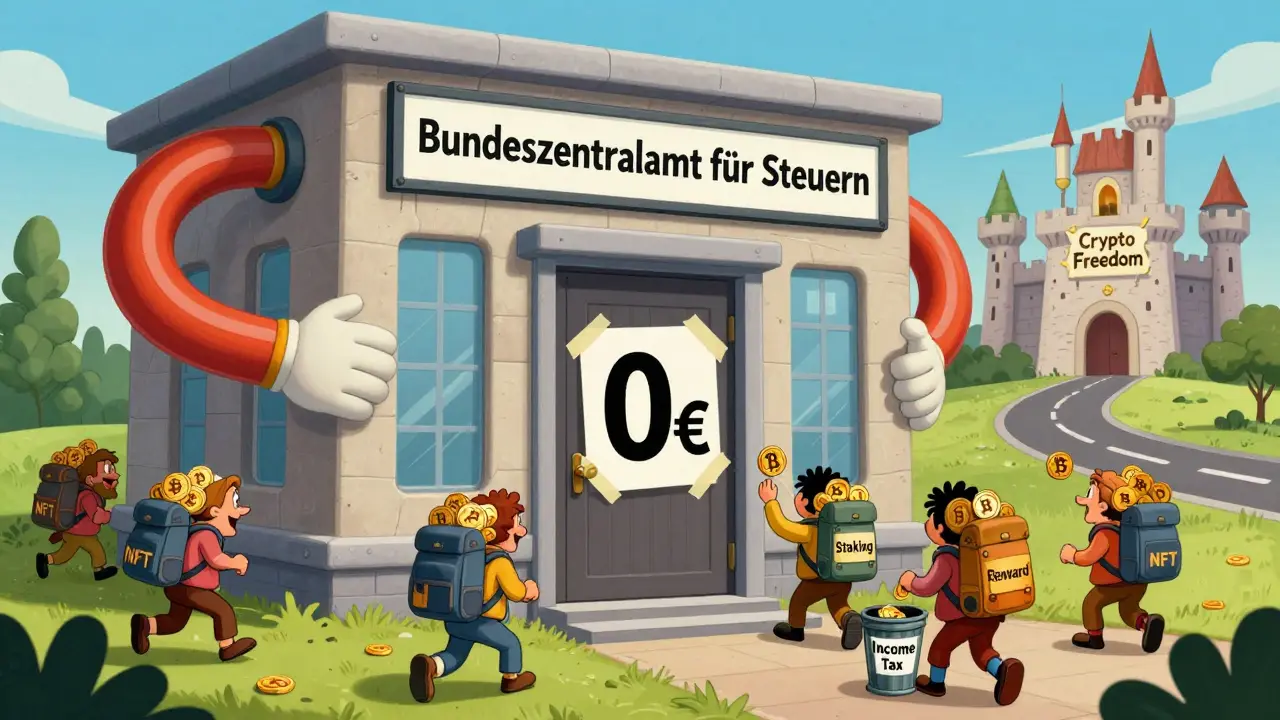

Germany doesn’t tax you on crypto profits if you hold your assets for at least one year. That’s it. No matter if you made €5,000 or €500,000, as long as you held the coins for 12 months or longer, you owe nothing. This rule applies to Bitcoin, Ethereum, altcoins, stablecoins, and even NFTs. The clock starts ticking the moment you buy or receive the crypto - down to the minute. No guesswork. No loopholes. Just a clear, simple deadline.This isn’t a temporary perk. It’s written into Section 23 of the German Income Tax Act (EStG). The Federal Central Tax Office (Bundeszentralamt für Steuern) enforces it, and it’s been in place for years. By 2025, around 30% of Germans owned some form of cryptocurrency, and this tax rule is why so many chose to hold long-term instead of flipping coins every week.

What Happens If You Sell Too Soon?

If you sell, swap, or spend your crypto before the one-year mark, things change fast. Short-term gains are taxed as income - not capital gains. That means your profit gets added to your regular income and taxed at your personal rate, which can go as high as 45%. Add the 5.5% Solidarity Tax on top, and you’re looking at nearly 47.4% in taxes on your profit.But there’s a small break: you get a €1,000 annual tax-free allowance for short-term gains. So if you made €800 in crypto profits before the year was up, you pay nothing. If you made €1,200, you only pay tax on the extra €200. That’s a big shift from the old €600 limit, which changed in 2024 to help casual traders.

Why This Rule Is a Global Oddity

Most countries don’t do this. In the UK, you get a £3,000 annual allowance, but anything over that is taxed at 10% or 20%. In France, every crypto trade - even if held for 10 years - gets hit with a flat 30% tax. Portugal used to be tax-free too, but regulators are tightening rules. And in the U.S.? Every crypto-to-crypto trade is a taxable event. You’re calculating gains on every swap, every staking reward, every payment you make with Bitcoin.Germany stands out because it treats crypto like gold or collectibles - not stocks or business income. If you hold it long enough, it’s just an asset you own. You don’t get taxed for letting it grow. That’s why Germany has become Europe’s largest crypto market by transaction volume, according to Chainalysis. Companies and investors are moving here not just for the economy, but for the clarity.

What You Need to Track

The rule sounds simple - but tracking your transactions isn’t. You need exact dates and amounts for every purchase and sale. If you bought 0.5 BTC on January 15, 2024, and another 0.3 BTC on March 8, 2024, and sold 0.7 BTC on February 1, 2025, you have to figure out which coins you sold and how long each batch was held. That’s called the FIFO method - first in, first out - and it’s mandatory in Germany.Many investors use crypto tax software like Koinly, CoinTracker, or Blockpit to automate this. These tools connect to your wallets and exchanges, pull all your transaction history, and calculate holding periods automatically. Setup takes a few hours, and most people can handle it themselves. But if you’re doing DeFi staking, lending, or complex swaps, you might need a German crypto accountant. Fees range from €150 to €500 a year, depending on how messy your history is.

Keep everything: exchange statements, wallet addresses, transaction hashes, screenshots of purchase prices. The tax office can audit you - and if you’re caught underreporting, penalties can hit 40% of the unpaid tax, plus interest.

What’s Not Covered

The zero-tax rule only applies to personal holdings. If you’re trading crypto as a business - buying and selling daily, running a mining operation, or running a DeFi protocol - you’re not covered. Those activities are treated as self-employment income and taxed normally.Staking rewards and interest from crypto lending are also tricky. Even if you hold the original coin for years, the rewards you earn each month are taxed as income in the year you receive them. So if you earn 0.02 ETH in staking rewards every month, you owe tax on that amount when it hits your wallet - even if you never sell it. The same goes for airdrops and hard forks. These aren’t capital gains - they’re ordinary income.

DeFi activities like liquidity provision or yield farming don’t have clear official guidance yet. The tax office hasn’t issued rules for them, so experts advise treating them conservatively - assume they’re taxable unless proven otherwise.

Real People, Real Results

German crypto investors on Reddit and forums like r/Finanzen talk about the "HODL advantage" all the time. One user shared how he bought Ethereum in early 2023 at €1,800. By November 2024, it hit €4,200. He waited until January 2025 - exactly 12 months and 3 days after purchase - and sold without paying a cent in tax. He used the money to buy a car.Another investor said he switched from short-term trading to long-term holding after realizing he was paying over €12,000 in taxes annually on his trades. After switching to the one-year rule, his tax bill dropped to zero. He now only buys and holds, adding small amounts each month.

But it’s not all easy. Many say the record-keeping is exhausting, especially if you’ve used multiple exchanges or wallets over the years. Some have spent weeks cleaning up old transaction logs just to prove their holding periods.

Is This Going to Change?

Right now, no. The German government has no plans to touch this rule before 2026. But the European Union’s MiCA regulation - which aims to standardize crypto rules across member states - could put pressure on Germany in the future. Other countries might push for more uniform taxation. Still, Germany’s economy is too big to ignore. It’s unlikely they’ll give up this advantage anytime soon.Analysts believe the policy will keep attracting blockchain startups, crypto funds, and private investors to Germany. It’s not just about taxes - it’s about trust. When you know exactly how the rules work, you can plan for the long term. That’s what makes this system powerful.

What Should You Do?

If you’re holding crypto in Germany:- Track every purchase date and amount - use software if you can.

- Wait at least 12 months before selling, swapping, or spending.

- Don’t assume staking rewards or DeFi income are tax-free - they’re not.

- Keep all records for at least 10 years - audits can happen years later.

- If you’re unsure about a transaction, consult a German crypto-savvy accountant.

If you’re not in Germany but thinking about moving your crypto holdings? Consider this: Germany offers one of the cleanest, most predictable crypto tax environments in the world. For long-term holders, it’s unmatched.

Is crypto really tax-free in Germany after one year?

Yes. If you hold any cryptocurrency - including Bitcoin, Ethereum, altcoins, or NFTs - for at least one full year from the date of acquisition, any profit from selling, swapping, or spending it is completely tax-free. This applies regardless of how large the gain is.

What if I sell before one year?

Short-term gains (under one year) are taxed as income. Rates range from 14% to 45%, plus up to 5.5% Solidarity Tax. However, you get a €1,000 annual tax-free allowance. So if your total short-term profit in a year is €1,000 or less, you pay nothing. Above that, only the excess is taxed.

Do I need to report my crypto even if I didn’t pay tax?

Yes. Even if you made zero tax on long-term holdings, you must still report all crypto transactions in your annual tax return (Einkommensteuererklärung). The German tax office requires full disclosure of all buys, sells, swaps, and transfers. Failing to report can trigger an audit.

Are staking rewards taxed in Germany?

Yes. Staking rewards, interest from crypto lending, and airdrops are treated as ordinary income. You pay income tax on them in the year you receive them, even if you never sell the underlying asset. The one-year holding rule does not apply to these types of earnings.

Can I use any wallet or exchange in Germany?

Yes, as long as you can prove ownership and transaction dates. Whether you use Coinbase, Kraken, a hardware wallet, or a decentralized exchange, the tax rule still applies. But you must be able to provide proof - like transaction hashes or wallet records - if audited. Using multiple wallets makes tracking harder, so keep records organized.

What about NFTs? Are they taxed the same?

Yes. NFTs are treated exactly like other cryptocurrencies under German tax law. If you hold an NFT for more than one year and then sell it, your profit is tax-free. If you sell within a year, the gain is taxed as income, with the same €1,000 annual allowance applying.

Is Germany’s crypto tax policy likely to change?

No changes are planned before 2026. While the EU’s MiCA regulation may push for more harmonization across member states, Germany’s size and influence make it unlikely they’ll give up this competitive advantage. Experts expect the one-year rule to remain stable for at least the next few years.

Do I need to pay tax if I gift crypto to someone?

Gifting crypto is considered a disposal under German law, so the giver may owe tax if the asset was held less than one year. If the asset was held longer than 12 months, the gift is tax-free for the giver. The recipient inherits the original purchase date and cost basis, so their holding period continues from when you bought it.

5 Comments

Sammy Tam

Germany’s crypto tax rule is straight-up genius. I’ve been watching this from the States and it’s wild how they treat crypto like gold instead of stocks. No more tracking every tiny trade just to avoid a tax nightmare. I wish the IRS would just say, ‘Hold it a year, you’re good.’ Simple. Clean. No bureaucracy. I’d move there tomorrow if I could.

Jonny Cena

This is exactly the kind of policy that encourages real wealth-building instead of gambling. I used to flip crypto like it was a poker game-until I realized I was paying more in taxes than I was making. Switching to long-term holding changed everything. Germany’s rule isn’t just tax-friendly, it’s psychologically freeing. You stop obsessing over daily price swings and start thinking in decades, not days. That’s the real win.

George Cheetham

There’s something deeply philosophical about this. Germany doesn’t punish growth. They don’t see your profit as something to be drained-they see it as evidence of trust, patience, and responsibility. In a world where everything is monetized, gamified, and taxed into oblivion, this is a quiet rebellion. It says: ‘If you build something lasting, we won’t take it from you.’ That’s not tax policy. That’s cultural wisdom. Most countries are still stuck in the 20th century, taxing innovation like it’s a sin. Germany’s already living in the 22nd.

Sue Bumgarner

Don’t let these crypto bros fool you-this isn’t some magical loophole, it’s a socialist trap disguised as freedom. The EU is already pushing to shut this down because it makes other countries look bad. And don’t get me started on how Americans are jealous and want to copy it without understanding the context. We don’t have the infrastructure, the culture, or the discipline to handle this. Plus, if everyone did this, the tax base would collapse. This is why Europe is falling behind-too much ‘let people keep everything’ nonsense. We need to tax the rich, not reward them with tax holidays.

Kayla Murphy

I’m just so inspired by how this works-people are actually planning for the future instead of chasing quick cash. It’s beautiful.