Crypto Strategy Calculator

Investment Details

Active Trading Settings

Results

HODL Strategy

Active Trading

Fee Comparison

Annual fees differ significantly between strategies

HODL (5 years)

Active Trading (5 years)

When you first buy Bitcoin or Ethereum, you’re faced with a choice that shapes your entire crypto journey: do you hold it forever, or do you try to time the market? This isn’t just a strategy-it’s a lifestyle. One keeps you up at night watching price charts. The other lets you sleep while your coins sit in a wallet you rarely check. Both have winners. Both have losers. But which one actually works better for most people?

HODL: The Simple Path to Long-Term Gains

HODL isn’t a typo. It’s a movement. It started in 2013 when a guy named GameKyuubi posted on BitcoinTalk, misspelling ‘hold’ during a market crash. He wrote, ‘I AM HODLING.’ That post went viral. And it wasn’t just humor-it was a philosophy. Buy crypto. Ignore the noise. Don’t panic sell. Wait.

Today, HODL means holding your crypto for years, not days. It’s the strategy used by people who bought Bitcoin at $300 in 2016 and still have it now, worth over $60,000. It’s the approach of Kristoffer Koch, who bought $26 worth of Bitcoin in 2009. He didn’t trade. He didn’t analyze charts. He just kept it. Today, that $26 is worth around $500,000.

The beauty of HODL is how little you need to do. You don’t need to know candlestick patterns. You don’t need to track news 24/7. You just need to buy from a trusted exchange like Coinbase or Binance, then move your coins to a hardware wallet like Ledger or Trezor. That’s it. The learning curve? Two to four weeks for a beginner to get secure.

Costs are low. If you buy once a month and hold, you pay maybe two or three trading fees a year. That’s $5-$15 total. Compare that to active traders who might make 10 trades a week-paying $10-$30 per trade. That’s $500-$2,000 a year just in fees.

And the results? Bitcoin grew over 280% from 2020 to 2023, even after two 80% crashes. Gold? Up 30% in the same period. HODLers didn’t catch every spike, but they didn’t get crushed by every dip either.

But here’s the catch: HODL isn’t risk-free. If the project fails, your coins become worthless. TerraUSD collapsed in 2022, wiping out billions. HODLers who held it lost everything. And if you misplace your private key? Chainalysis says 20% of all Bitcoin is already lost-forever-because someone forgot their password or lost their hardware wallet.

Still, most HODLers report lower stress. A 2023 EBC survey found 78% of long-term holders felt calmer than active traders. You don’t have to watch your portfolio every hour. You don’t have to second-guess every alert. You just wait. And if you believe in crypto’s long-term future, that’s powerful.

Active Trading: The High-Stakes Game

Active trading is the opposite. It’s not about waiting. It’s about reacting. Day traders open and close positions in hours. Swing traders hold for days or weeks. Scalpers make dozens of trades a day, chasing pennies.

This isn’t a side hustle. It’s a job. Phemex Academy says active traders spend 15-20 hours a week analyzing charts, reading news, and managing orders. You need tools like TradingView ($15/month), exchange APIs, and risk management systems. You need to understand volume spikes, RSI divergences, and support/resistance levels.

The goal? Profit from volatility. Crypto moves 5-10% in a single day. The S&P 500? 0.5%. That’s why traders flock here. In March 2023, one trader on TradingView captured 42% in three weeks by riding a swing in Solana. That’s the dream.

But here’s the hard truth: only 1-4% of day traders make consistent profits long-term. That’s not a rumor. It’s what multiple brokers and studies (ZebPay, Binance, CoinDesk) have found. Most people lose money. Why? Because emotions win. Fear makes you sell low. Greed makes you buy high. Revenge trading after a loss? 85% of traders admit they’ve done it.

And the costs add up fast. Each trade on Binance costs 0.1-0.6%. If you make 50 trades a month, that’s $50-$300 in fees alone-not counting slippage, where your order fills at a worse price than expected. In slow markets, like Bitcoin’s 2019 consolidation, volatility drops below 15% for months. No swings. No profits. Just fees eating your account.

Active trading also demands constant attention. You can’t take a weekend trip. You can’t go on vacation without setting alerts. You’re always on call. A 2023 CoinDesk survey found 79% of former day traders quit because they were burned out.

Still, some thrive. Benjamin Cowen, a professional crypto trader, made 300% in 2021 using systematic swing trading. He didn’t guess. He had rules: enter only when volume spiked above 200-day average, exit if price dropped 5% below entry. He didn’t let emotion drive him. He let data do the work.

But that’s rare. Most people who try active trading don’t have the discipline, time, or skills. And the market is getting harder. Algorithmic trading now controls over 60% of crypto volume. Retail traders are racing against machines that react in milliseconds.

Which One Is Right for You?

There’s no universal answer. But there’s a clear match for most people.

If you’re new to crypto, have a full-time job, and don’t want to spend hours staring at charts-HODL is your best bet. It’s simple, low-cost, and emotionally manageable. You can start with $50. You can set up auto-buying every Friday. You can sleep at night.

If you’re a full-time trader, love markets, have experience with technical analysis, and can handle stress-active trading might work. But even then, most experts recommend limiting it to a small slice of your portfolio.

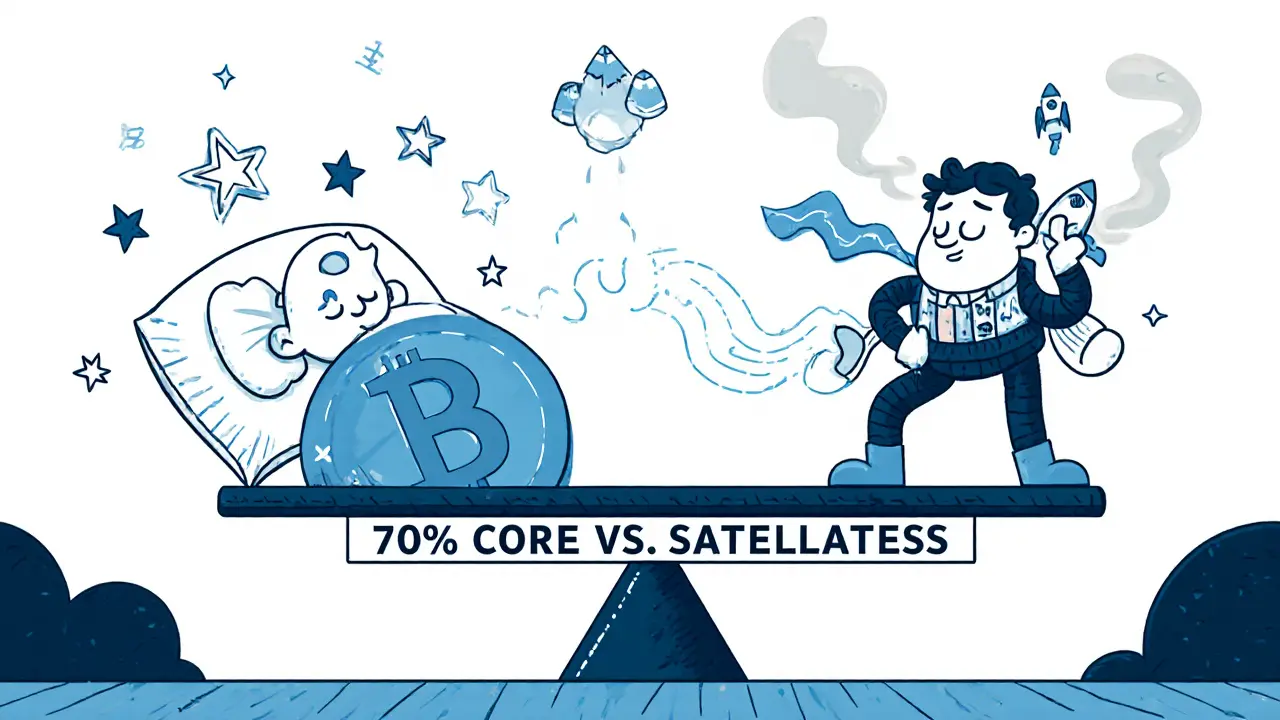

Here’s what the pros do: the core-satellite model. 70-80% of your crypto is HODLed in Bitcoin and Ethereum. The other 20-30% is used for active trading. That way, you’re not risking your life savings on a single trade. You’re using your trading capital like a bonus fund.

And here’s the secret most people miss: HODL isn’t passive in the lazy sense. It’s active in the emotional sense. You have to hold through panic. You have to ignore FOMO during bull runs. You have to believe when everyone else is selling. That’s harder than it sounds.

Reddit user u/BitcoinBull2020 summed it up: ‘I held through three crashes. Now I’m up 1,200% since 2017. My day trading account? Gone. Zero stress compared to that.’

The Hybrid Approach: Why Most Successful Investors Use Both

Forget the either/or mindset. The smartest investors don’t choose one. They use both.

Think of it like a house. You don’t live in a vacation home. You live in your primary residence. But you might rent out a second property for extra income. Same with crypto.

Your core holdings? HODLed in Bitcoin and Ethereum. Secure. Long-term. Unshakable.

Your satellite plays? Active trading in altcoins with high volatility-Solana, Polygon, or new tokens with strong momentum. You set clear rules: max 5% risk per trade. Stop-loss at 7%. Take profit at 20%. No exceptions.

This approach works because it balances risk and reward. You’re not betting everything on luck. You’re not missing out on growth because you’re too scared to trade.

According to Messari’s 2023 report, 41% of experienced crypto investors now use this hybrid model. It’s not just a trend-it’s becoming the standard.

What’s Changing in 2025?

The crypto landscape is shifting. HODL is evolving. You can now earn yield on your holdings. Staking Ethereum gives you 3-8% annual returns. DeFi protocols like Aave offer 5-15% on stablecoins. You’re not just holding-you’re earning.

Active trading is getting harder. AI tools like Coinrule now backtest strategies using years of data. Binance is cutting order processing to under 10 milliseconds. Retail traders are outgunned by algorithms.

Regulation is tightening too. The SEC’s lawsuits against Coinbase and Binance shook the market. New rules in the EU limit leverage to 25x. That’s good for HODLers-less speculation. Bad for day traders-less leverage means smaller profits.

And the big picture? Crypto’s total market cap dropped from $2.5 trillion in 2021 to $1.03 trillion in late 2023. That’s brutal. But it’s also a reset. The hype is gone. Only the believers remain.

That’s why HODL is winning. It’s not flashy. It doesn’t make headlines. But it survives.

Final Verdict: Pick Your Path

Here’s the truth: most people should HODL.

Not because trading is bad. But because most people aren’t cut out for it. The stress, the time, the cost, the odds-it’s stacked against you.

HODL doesn’t promise quick riches. It promises something better: peace of mind. Growth over time. A chance to benefit from crypto’s long-term potential without losing your sanity.

But if you’re the type who loves markets, can handle the grind, and have the discipline to stick to a plan-then trade. Just don’t put your life savings in it. Use a small portion. Treat it like a side project. Not your retirement.

The best investors aren’t the ones who made the most trades. They’re the ones who held through the worst moments-and didn’t sell.

9 Comments

Abby cant tell ya

lol i bought dogecoin at 0.01 and sold at 0.08 because i thought the moon was coming. turned out the moon was just a glitch in my phone. now i just stare at my btc wallet like it’s my therapist. no trades, no alerts, just vibes.

Eddy Lust

hodling feels like planting a tree and forgetting you planted it. then one day you’re sitting in the shade, sipping coffee, wondering why everyone’s running around with chainsaws. i lost my first 3 wallets to bad passwords. now i write my seed phrase on paper, bury it in a tin can, and pretend i don’t know where it is. peace of mind > paper gains.

Tom MacDermott

hodl? more like h0d1. you’re not an investor, you’re a crypto cultist with a hardware wallet and zero critical thinking. 2017 called, it wants its delusional believers back. meanwhile, real traders are making bank while you’re crying over a 15% dip. 🤡

Janice Jose

i get where tom’s coming from, but i think both sides have merit. i hodl 80% of my crypto like a vault-btc and eth, locked up. the other 20%? i swing trade like it’s a side hobby. it’s not about being right, it’s about not losing your chill. if you’re stressed, you’re doing it wrong.

Casey Meehan

you guys are all missing the point 😤

stake your eth, earn 6% APY, and use that passive income to dollar-cost average into new alts. then trade 5% of your portfolio with ai bots that run 24/7. 🤖💰

hodl is for grandmas. smart money uses the hybrid model. also, if you don’t have a cold wallet, you’re not even playing the game. 🛡️

Susan Dugan

my cousin traded for 2 years. lost $18k. now he hodls 3 btc and sleeps like a baby. he told me: ‘i used to check my phone every 3 minutes. now i check it once a month. i feel like i got my life back.’

you don’t need to be a genius to win in crypto. you just need to be stubborn. and patient. and not addicted to dopamine hits from green candles. 🌱

Tony spart

hodl? that’s what you do when you’re too lazy to learn real trading. america’s got too many soft people who think ‘buy and pray’ is a strategy. real men trade. real men use leverage. real men don’t cry when their portfolio dips. 🇺🇸🔥

if you’re not trading, you’re just storing digital receipts.

Vaibhav Jaiswal

in india, we say: ‘jaldi mat karo, der se karo’ - don’t rush, do it late. same with crypto. i bought btc in 2019 at $4k. didn’t touch it. now i make 10% a year just staking. i don’t need to be a trader. i just need to be consistent. 🙏

and yes, i lost 2000 rupees to a fake exchange once. learned my lesson. now i only use binance. simple.

Martin Doyle

you’re all wasting time arguing. the hybrid model is the only sane way. 80% hodl, 20% trade. but here’s the kicker - if you’re trading, you better have a written plan with entry, exit, and stop-loss. no emotions. no ‘maybe’.

i had a friend who made 400% on solana last year. then blew it all on revenge trading after a 10% loss. he’s back to hodling now. same as everyone else.

the market doesn’t care if you’re ‘smart.’ it cares if you’re disciplined. and most people? they’re not. so just hodl. and stop reading reddit like it’s a trading course.