Norway Data Center Fine Calculator

Calculate Your Potential Fine

Norway's data center registration law requires all data centers to register by July 1, 2025. Non-compliance carries fines up to 5% of annual turnover.

Estimated Fine

Maximum fine: $0

Minimum fine: $0

On January 1, 2025, Norway became the first country in Europe to legally require every data center to register with the government. But here’s the catch: if you’re running a cryptocurrency mining operation, you’re not just registering-you’re under a clock. By autumn 2025, no new crypto mining data centers can be built. And if you’re already running one? You’re stuck in a gray zone-allowed to keep going, but never allowed to grow.

Why Norway Is Shutting the Door on Crypto Mining

Norway doesn’t lack power. It has more hydroelectric dams than almost any country on Earth. Its grid runs on nearly 100% renewable energy. So why ban crypto mining? It’s not about energy scarcity. It’s about priorities. Government officials, including Energy Minister Terje Aasland and Digitalization Minister Karianne Tung, say crypto mining uses massive amounts of electricity but creates almost no local jobs, no tax revenue, and no lasting economic value. Meanwhile, factories, aluminum smelters, and data centers for public services are struggling to get enough power. The government sees crypto mining as a luxury that’s crowding out essential industries. Minister Tung put it bluntly: "The Labour Party government has a clear intention to limit the mining of cryptocurrency in Norway as much as possible." This isn’t a moral stance against Bitcoin. It’s a resource allocation decision. Norway’s energy isn’t free-it’s a public asset. And the government decided it should power things that benefit Norwegians, not offshore investors.The Two-Part Law: Registration and the Ban

Norway’s approach isn’t one law. It’s two tightly linked rules, enforced by different agencies. First, the data center registration system, run by the Norwegian Communications Authority (Nkom), requires every data center-whether it’s hosting a website, a hospital server, or a Bitcoin farm-to register by July 1, 2025. That means submitting:- Company name and legal status

- Physical address and ownership details

- Name and contact info of a government liaison

- Complete list of customers-specifically noting if any are crypto mining operations

- Detailed description of services provided

Who’s Getting Hit the Hardest?

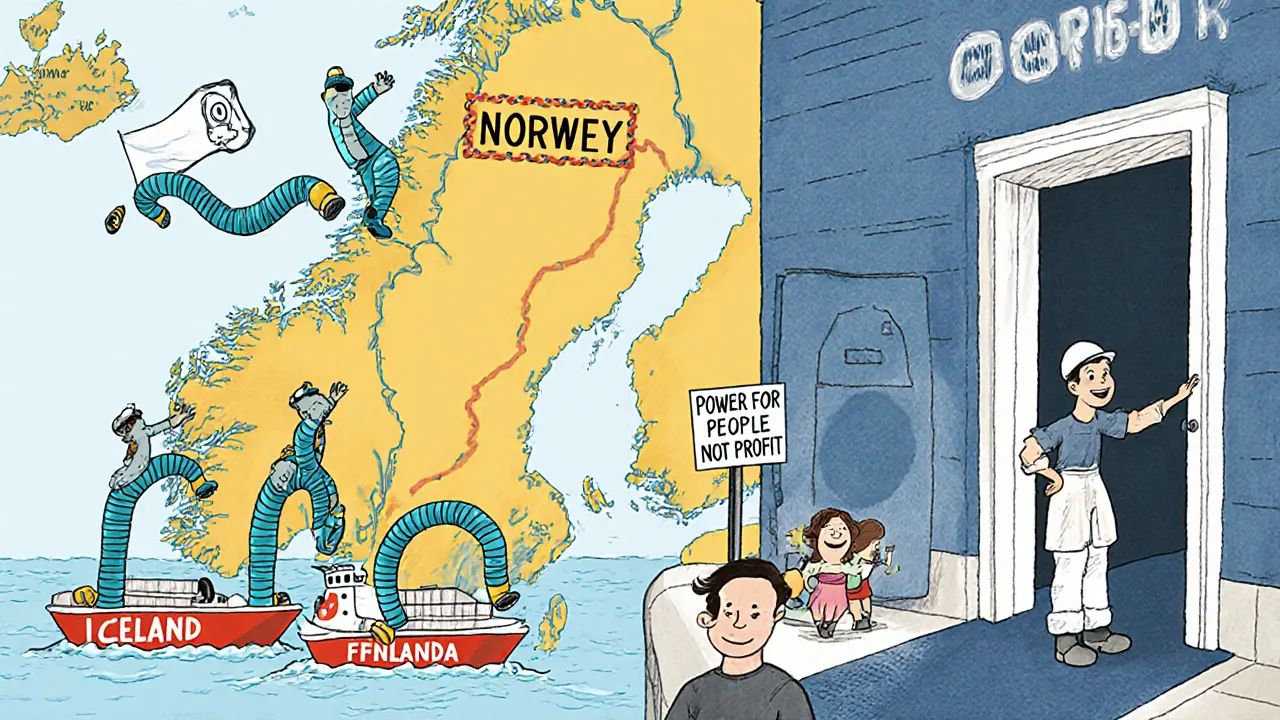

Small operators and independent miners are feeling the squeeze the most. Large mining companies with legal teams and global offices can absorb the cost of registration, compliance reports, and shifting operations. But a guy in Tromsø running 200 ASICs out of a converted warehouse? He’s got to hire a lawyer, fill out dozens of forms, and pay for audits-all just to stay open. Many small miners have already shut down. Others are quietly moving their hardware to Iceland, Finland, or even Texas, where power is cheap and regulations are lighter. Even existing operations aren’t safe. There’s no guarantee the ban won’t expand. If the government decides crypto mining is still using too much power, they could come after current facilities next. Operators are bracing for that.

How This Compares to Other Countries

Norway’s move is unusual-even radical-in the Nordic region. Iceland, Sweden, and Finland have spent years trying to attract crypto mining. They offered low electricity prices, stable grids, and cool climates. Iceland’s data centers used to be 30% crypto mining. Now? Many are closing or relocating to Norway’s neighbors. China banned crypto mining outright in 2021. Norway isn’t doing that. It’s more surgical: allow the past, block the future. That’s why experts call it a "soft ban." It’s less about punishing miners and more about freezing the sector in place. The EU’s MiCA regulation, rolling out in 2025, will require crypto businesses to report more about their operations. But MiCA doesn’t touch energy use. Norway’s rules go further. They’re not just regulating money-they’re regulating electricity.What’s Happening to the Industry?

The market is already shifting. Mining companies that had plans to build in Norway are now looking at Sweden’s data center hubs, Finland’s Arctic facilities, and even Canada’s Quebec region. Some are moving to the U.S., where states like Georgia and Kentucky are offering tax breaks for crypto operations. The global hash rate-the total computing power behind Bitcoin-isn’t falling. It’s just moving. Norway’s restrictions are pushing mining away from the Nordic clean energy model and toward places with less oversight. That raises a bigger question: Is decentralization being undermined? If mining becomes concentrated in a few low-regulation countries, does that make Bitcoin more vulnerable to control or manipulation?

What’s Next for Norway?

The government hasn’t said it’s done. Ministers have hinted that the autumn 2025 ban might be just the beginning. If energy demand from mining continues to rise-even without new facilities-there could be new rules. Maybe a cap on total power usage for crypto. Maybe a tax on mining energy. Maybe even limits on how much power a single operator can use. For now, Norway is testing a new model: what if a country said no to crypto mining not because it’s dangerous, but because it’s wasteful? It’s a bold experiment. And the world is watching.What Should Miners Do Now?

If you’re operating a crypto mining facility in Norway:- Register with Nkom immediately if you haven’t already. The deadline passed in July 2025. Late registration means fines.

- Document every piece of hardware, every power meter reading, and every customer contract. You’ll need it if audited.

- Don’t plan any expansions. Even adding a few more ASICs could trigger enforcement.

- Consider relocating if you’re small or undercapitalized. The regulatory risk is rising.

- Don’t. It’s not worth the legal risk.

- Look at Iceland, Finland, or Canada instead.

- Remember: Norway’s rules could become the template for other energy-rich countries.

Why This Matters Beyond Norway

Norway isn’t just making policy. It’s setting a precedent. Other countries with abundant renewable energy-Canada, Sweden, Finland, even parts of the U.S.-are watching closely. If Norway’s ban works-meaning energy prices stay stable, industries thrive, and the grid remains reliable-others may copy it. This could be the start of a global trend: renewable energy isn’t for everyone. It’s for what society values most. Crypto mining might be a technological marvel. But in Norway, it’s not seen as essential. And that’s the real story here.Is crypto mining completely banned in Norway?

No. Only new crypto mining data centers are banned as of autumn 2025. Existing operations are allowed to continue running, but they cannot expand or add new equipment that increases power usage. The ban is focused on growth, not elimination.

Do I need to register my data center in Norway?

Yes. All data centers in Norway, regardless of use, must register with the Norwegian Communications Authority (Nkom) by July 1, 2025. Failure to register carries fines of up to 5% of annual turnover. The registration requires details about ownership, location, customers, and services-including whether crypto mining is being performed.

Why is Norway targeting crypto mining but not other industries?

Norway’s government argues that crypto mining uses massive amounts of electricity but creates almost no local jobs, tax revenue, or economic value. Meanwhile, industries like aluminum smelting, manufacturing, and public infrastructure need that same power to operate. The government sees crypto mining as a low-benefit, high-cost use of a public resource.

What happens if I don’t comply with Norway’s rules?

Non-compliance can lead to fines of up to 5% of your company’s annual turnover. Authorities can also shut down operations, seize equipment, or block power connections. Registration is mandatory, and enforcement is strict. Even small operators are being audited.

Can I move my mining equipment to another Nordic country?

Yes. Many operators have already relocated to Iceland, Finland, and Sweden, where electricity remains cheap and regulations are more favorable. These countries are actively attracting mining businesses that left Norway. However, each country has its own rules-research before moving.

Will Norway ban existing mining operations in the future?

The government hasn’t said so yet, but officials have hinted that the current ban may be just the first step. If energy demand from mining continues to rise, future restrictions could include power caps, taxes, or even phase-outs of existing operations. Operators should assume the risk is growing, not shrinking.

8 Comments

Angel RYAN

So Norway just said no to crypto mining because it doesn’t create jobs? Funny how they don’t say the same about oil rigs or luxury yachts powered by the same grid. This isn’t about fairness-it’s about who gets to decide what’s valuable.

And now everyone’s just gonna pack up and move to Iceland or Texas? Great. So we’re not solving the problem-we’re just exporting it. The planet doesn’t care if your mining rig is in Tromsø or Texas. The electricity still gets burned.

It’s like banning fast food because it’s unhealthy, then letting people buy it across the border and eat it in their cars. Doesn’t fix anything.

Savan Prajapati

They’re right. Mining uses power for nothing. No jobs. No taxes. Just rich guys getting richer. Norway’s being smart. Move elsewhere if you can’t play by the rules.

imoleayo adebiyi

As someone from Nigeria where electricity is a luxury and blackouts are routine, I find this policy deeply thoughtful. In many parts of the world, power isn’t a resource to be wasted-it’s a lifeline.

Norway isn’t rejecting crypto because it’s evil. It’s rejecting it because it’s a luxury good in a society that has already solved its basic needs. That’s not hypocrisy. That’s wisdom.

Imagine if every country with abundant renewable energy made the same choice. The global hash rate might shift, but the moral clarity would be refreshing. We don’t need more mining-we need better priorities.

Abby cant tell ya

Oh please. Crypto miners are just tech bros with ASICs and delusions of grandeur. They think they’re revolutionizing finance but they’re just burning electricity to make rich people richer.

Norway’s doing the right thing. Let the crypto bros go cry in Texas. At least here, the grid powers hospitals, not gambling rigs.

Janice Jose

I get why Norway did this. My cousin runs a small data center for a local clinic. She’s been fighting for years to get more power. Meanwhile, some guy in Oslo is running 500 rigs just to make a few extra bucks off Bitcoin.

It’s not fair. And it’s not sustainable. I’m not anti-crypto. I’m pro-people. Let the miners go elsewhere. Let our schools and hospitals get the power they need.

Ben Costlee

Let’s be real-this isn’t about energy. It’s about control.

Norway’s government doesn’t like that crypto operates outside their system. It doesn’t pay taxes. It doesn’t answer to regulators. It doesn’t need their permission to exist.

So they created a bureaucratic trap: register everything, then ban growth. They didn’t outlaw mining. They outlawed autonomy.

And now the whole industry is being pushed toward places with less transparency, less oversight, and more corruption. Is that really the outcome they wanted?

It’s not that crypto mining is wasteful. It’s that it’s inconvenient. And convenience is the new morality in modern governance.

What happens next? Will they ban cloud computing because it doesn’t create local jobs? Will they shut down streaming servers because they don’t pay property taxes?

This isn’t policy. It’s power play dressed up as sustainability.

ola frank

The structural inefficiency of proof-of-work mining in the context of constrained public energy infrastructure is a textbook case of misaligned incentive structures.

Norway’s hydroelectric capacity, while abundant, is not infinite nor unallocated. The marginal utility of electricity diverted to non-productive, non-tax-generating, non-employment-creating computational work-i.e., crypto mining-is demonstrably lower than that allocated to industrial electrolysis, public cloud infrastructure, or medical data systems.

The regulatory framework is not a ban-it’s a Pareto-optimal reallocation mechanism. By mandating registration, the state achieves transparency without immediate coercion. The de facto moratorium on expansion preserves existing operational legitimacy while preventing further entropy in grid load distribution.

What’s fascinating is the geopolitical ripple effect: this policy implicitly redefines energy sovereignty as a public good, not a commodity to be leased to speculative capital. The EU’s MiCA is toothless in comparison. Norway has introduced a new paradigm: energy access as a civic contract, not a market transaction.

And yes, the lack of a wattage threshold is intentional. Ambiguity as a regulatory tool forces compliance through risk aversion. It’s not sloppy-it’s strategic. The operators who can’t navigate ambiguity are the ones who shouldn’t be here in the first place.

Vaibhav Jaiswal

They’re not banning crypto. They’re banning laziness. Why burn power for nothing when you could be building something real? Move your rigs. Grow somewhere else. Norway’s not your personal power plant.