DEX Liquidity Risk Calculator

Calculate the risk level of a cryptocurrency exchange based on its daily trading volume. Industry standards suggest exchanges with less than $100,000 daily volume likely cannot afford security audits or basic operations.

For comparison:

- Uniswap $1.2B

- PancakeSwap $850M

- Taffy Finance $700.64

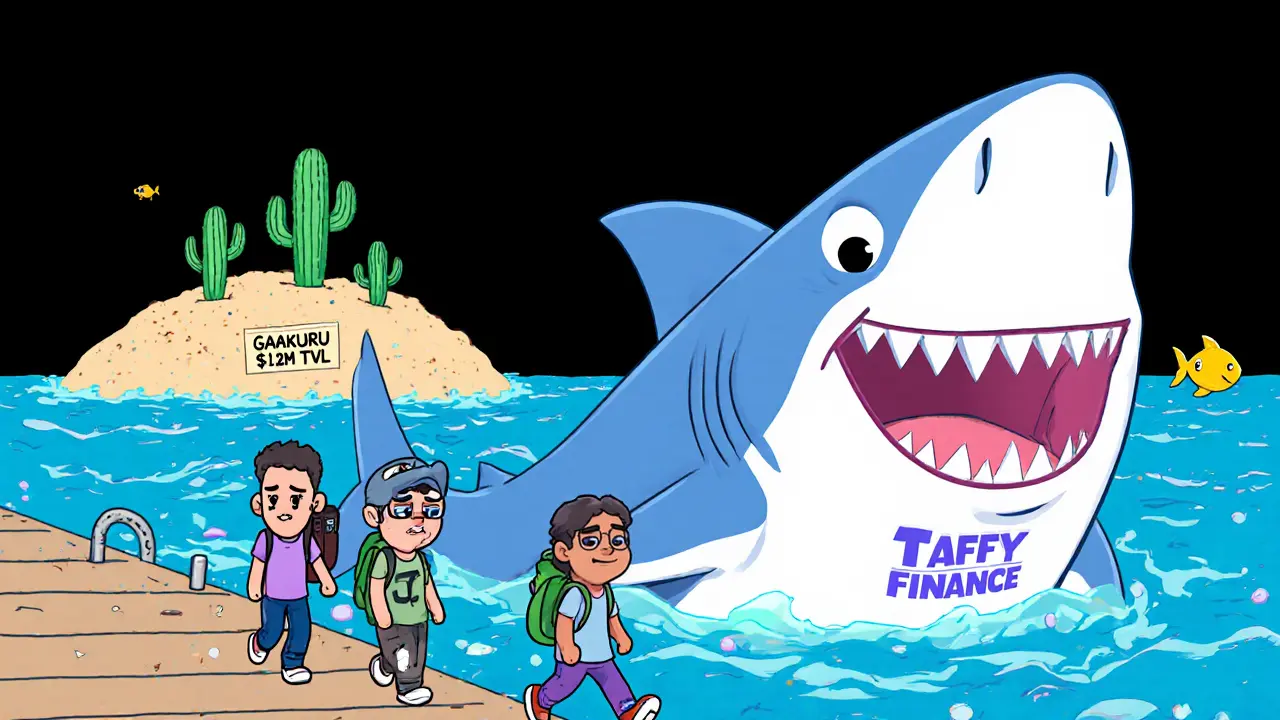

When you hear "Taffy Finance" as a crypto exchange, you might picture a sleek platform where gamers trade rare tokens with ease. But the reality is far different. As of October 2025, Taffy Finance reported a 24-hour trading volume of just $700.64. That’s less than the cost of a mid-range gaming headset. For comparison, Uniswap moves over $1 billion in the same time. This isn’t a niche platform-it’s a ghost town.

What Is Taffy Finance, Really?

Taffy Finance claims to be a decentralized exchange (DEX) built on the Saakuru blockchain. It says it’s designed for gaming tokens, promising to connect players and blockchain projects. But there’s no whitepaper. No GitHub repo. No audit reports. No team page. Even the official website doesn’t list a single token pair that’s actively tradable. CoinMarketCap lists it, but the trading data shows "Loading data..."-a red flag that the platform may not be functional at all.Why the Trading Volume Is a Major Warning Sign

Trading volume isn’t just a number-it’s proof people are using the platform. A DEX with under $1 million in daily volume is considered tiny. Taffy Finance’s $700.64 is 1,420 times lower than the minimum threshold experts say is needed to cover basic operational costs. DeFi Llama’s data shows the entire DEX market processed $42.7 billion in daily volume in October 2025. Taffy Finance accounts for 0.0000016% of that. That’s not "emerging." That’s invisible.No Community. No Users. No Trust

Look at any legitimate crypto project, even a small one. You’ll find Reddit threads, Twitter discussions, Telegram groups, and user reviews. Taffy Finance has none. A search on Reddit for "Taffy Finance" returns zero results in r/defi, r/CryptoCurrency, or even r/SaakuruNetwork. Twitter has three mentions in the last 90 days-none from real users. Trustpilot, alternative.to, and CryptoSlate have no reviews at all. If no one’s talking about it, it’s because no one’s using it-or they’ve been burned.Game Tokens? The Claim Doesn’t Match Reality

Taffy Finance markets itself as a hub for gaming tokens. That’s a real market. In Q3 2025, gaming-related tokens made up 12% of all new crypto launches, according to DappRadar. But Taffy Finance doesn’t list a single gaming token. GameSwap, a real gaming-focused DEX, supports 287 token pairs across five blockchains. Taffy Finance has none. There’s no evidence of partnerships with game studios, no integration with in-game economies, no NFT marketplace links. The gaming angle feels like a marketing tactic with zero substance.

How It Compares to Real DEX Platforms

| Feature | Taffy Finance | Uniswap | PancakeSwap |

|---|---|---|---|

| 24h Trading Volume | $700.64 | $1.2B | $850M |

| Blockchain | Saakuru (unverified) | Ethereum | BNB Chain |

| Security Audits | None | Multiple (OpenZeppelin, CertiK) | 7+ audits (PeckShield, Quantstamp) |

| Community Size | 0 verified users | 1.2M Twitter followers | 450K Twitter followers |

| Developer Docs | None | 200+ page API guide | Comprehensive SDK and tutorials |

| Support Channels | None | Discord, Telegram, Help Center | 45K Telegram, 32K Discord |

The Saakuru Blockchain: A Mystery Network

Taffy Finance runs on Saakuru, but no one outside its own website talks about it. DefiLlama shows Saakuru has only three active dApps and $1.2 million in total value locked (TVL). Compare that to Ethereum ($42B TVL) or BNB Chain ($8.7B). Saakuru isn’t just small-it’s irrelevant in the broader crypto ecosystem. Without a strong blockchain foundation, a DEX can’t survive. No one wants to trade on a chain with no liquidity, no developers, and no users.Is Taffy Finance a Scam?

It’s not officially labeled a scam by regulators or watchdogs like Cryptolegal.uk. But it ticks every box of a high-risk project: zero transparency, no community, no documentation, and trading volume so low it’s statistically meaningless. Industry analysts at Delphi Digital say any DEX under $100,000 daily volume can’t afford to pay for security audits or maintain servers. Taffy Finance doesn’t even hit $1,000. That means it’s either abandoned or designed to lure small deposits with fake promises.

Who Should Avoid Taffy Finance

If you’re a casual crypto user, a gamer looking to trade in-game assets, or someone who values security and transparency-stay away. This isn’t a platform for learning or experimenting. It’s a dead end. Even if you’re willing to risk a small amount of crypto, there’s no guarantee you can withdraw your funds. No support channels mean no help if something goes wrong. And with no smart contract audit, you’re trusting code that’s never been checked for vulnerabilities.What to Do Instead

If you want to trade gaming tokens, use platforms that actually work. GameSwap lists hundreds of gaming tokens and has real volume. Uniswap and PancakeSwap support dozens of gaming-related tokens and have millions in liquidity. If you’re new to DEXes, start with one of these. Learn how to connect your wallet, understand slippage, and check liquidity pools before touching anything obscure.Final Verdict

Taffy Finance isn’t a crypto exchange you can trust. It’s a placeholder with no users, no infrastructure, and no future. The $700 trading volume isn’t a startup hiccup-it’s a tombstone. The Saakuru network is a dead end. The gaming token promise is empty. There’s no roadmap, no team, no updates. If you’re looking for a DEX to use, Taffy Finance should be at the bottom of your list-below every other unknown platform. Skip it. Save your time. Save your crypto.Is Taffy Finance safe to use?

No. Taffy Finance has no security audits, no verified team, no customer support, and no real user activity. Its trading volume is below $1,000, which means it likely can’t cover basic operational costs, let alone secure user funds. There’s no evidence it’s functional beyond a basic webpage.

Does Taffy Finance support gaming tokens?

There is no proof it supports any gaming tokens. While it claims to focus on gaming, no token pairs, partnerships, or listings have been verified. Real gaming DEXes like GameSwap list hundreds of tokens-Taffy Finance lists none.

Why is the trading volume so low?

The volume is low because no one is using it. There are no users, no marketing, no liquidity pools, and no community. Without these, a DEX can’t attract traders. A volume of $700 suggests either the platform is inactive or designed to appear legitimate while offering no real service.

Can I withdraw my funds from Taffy Finance?

There’s no way to know. No support channels, help center, or user reports exist. If you deposit funds, you risk losing them permanently. Even if the interface appears to work, there’s no guarantee the smart contract allows withdrawals or isn’t designed to trap assets.

Is Taffy Finance listed on CoinMarketCap?

Yes, it’s listed-but that doesn’t mean it’s legitimate. CoinMarketCap lists hundreds of low-activity or inactive projects. A listing only means the project submitted data-it doesn’t verify functionality, security, or user activity. The "Loading data..." status on its page confirms the data is unreliable.

Should I invest in Taffy Finance’s native token?

Absolutely not. There is no verified native token for Taffy Finance. Even if one exists, there’s zero liquidity, no exchange listings, and no reason to believe it has any value. Investing in it would be gambling with no odds in your favor.

Are there any alternatives to Taffy Finance for gaming tokens?

Yes. GameSwap, Uniswap, and PancakeSwap all support gaming tokens with real liquidity and active communities. GameSwap alone lists over 280 gaming tokens. These platforms have audits, support, and millions in daily volume. Stick with them instead of unverified projects like Taffy Finance.

9 Comments

Joel Christian

bro i just deposited 0.5 eth into taffy finance bc i thought it was gonna be the next big thing… now my wallet’s just sitting there like a ghost… i dont even know if i can withdraw???

jeff aza

Let’s be clear: Taffy Finance’s $700.64 24h volume isn’t ‘low’-it’s mathematically non-viable. A DEX requires liquidity depth, not just a frontend. The Saakuru chain? A blockchain with a total TVL of $1.2M? That’s not a chain-it’s a sandbox. No audits, no devs, no docs. This isn’t a startup-it’s a honeypot with a landing page. And CoinMarketCap listing? Please. They list spam bots with more utility.

Vijay Kumar

You think this is bad? Wait till you see the ‘decentralized’ casinos on Saakuru. Zero transparency. Zero accountability. Just vibes and vaporware. Real men don’t gamble on ghosts.

Vance Ashby

lol i checked their site… the ‘contact’ button just links to a dead Discord invite. 🤡

Brian Bernfeld

Look, I get it-you’re excited about gaming tokens. I am too. But this isn’t ‘early adoption.’ This is ‘early graveyard.’ GameSwap has 287 pairs, real audits, and a community that actually talks. Uniswap and PancakeSwap? They’ve got millions in volume because people trust them. Taffy Finance? It’s a .html file with a fake counter. Don’t be the guy who lost his crypto to a placeholder. Learn the basics. Stick to platforms that don’t make you feel like you’re debugging a broken script. You deserve better than vapor.

Ian Esche

USA doesn’t need this trash. If you’re gonna build a DEX, do it right. This is why crypto gets a bad name. Stop letting foreign no-accounts get away with this. Block it. Report it. Burn it.

Felicia Sue Lynn

It’s sad, really. Innovation shouldn’t be drowned by negligence. There’s potential in gaming tokens, in decentralized finance, in community-driven platforms-but when projects like this emerge without transparency, they erode trust not just in themselves, but in the entire ecosystem. We should be building bridges, not mirages.

Christina Oneviane

Oh wow, so Taffy Finance is a ‘ghost town’? I guess that explains why the ‘team’ photo is just a stock image of a guy in a hoodie holding a coffee mug labeled ‘Web3 Legend.’ 😘

fanny adam

There is a pattern here: low-volume, no-audit, no-team projects are frequently coordinated exit scams. The Saakuru blockchain has been flagged by Chainalysis for anomalous wallet clustering. The domain was registered under a privacy-protected WHOIS record in a jurisdiction with no crypto regulations. The ‘gaming token’ claim is a red herring-no game studio has ever partnered with them. This is not negligence. This is engineered deception. Proceed at your own risk-but understand: your funds are already lost.