Newton Protocol isn’t just another crypto coin. It’s a behind-the-scenes engine making your DeFi trades smarter, safer, and fully automated - without ever giving up control of your funds. If you’ve ever wished your crypto could rebalance itself, chase yield across platforms, or react to price swings while you sleep, Newton Protocol is what makes that possible. And its native token, NEWT, is the fuel that keeps it all running.

What Newton Protocol Actually Does

Most blockchains let you run simple smart contracts - like swapping tokens or locking up ETH for interest. But what if you want to do something complex? Like automatically moving your funds from Aave to Compound when interest rates drop, then buying more ETH if BTC hits $70K, all while keeping your private keys safe? That’s where Newton Protocol steps in.

It’s the first blockchain layer built specifically for verifiable automation. Instead of trusting a bot or a third-party service to act on your behalf, Newton lets you delegate tasks to AI-driven agents - but with cryptographic proof that every action follows your exact rules. No surprises. No hacks. No rug pulls.

Think of it like hiring a financial assistant who can’t touch your wallet, but can still make trades for you - because they’re forced to prove every move is allowed. That’s the magic of zkPermissions and Trusted Execution Environments (TEEs).

How NEWT Token Powers the Network

NEWT isn’t just a speculative asset. It’s the backbone of the entire system. Here’s what it actually does:

- Security: Validators stake NEWT to run nodes and secure the network. If they misbehave, they lose part of their stake.

- Transaction Fees: Every automated action - whether it’s a portfolio rebalance or a yield harvest - costs a small amount of NEWT to process.

- Agent Marketplace: Developers publish AI agents (pre-built automation rules) on the Newton Model Registry. Users pay NEWT to use them. Developers earn NEWT for creating useful tools.

- Governance: NEWT holders vote on upgrades, fee structures, and new features. The more you hold, the more influence you have.

The total supply of NEWT is fixed at 1 billion tokens. About 35% is reserved for ecosystem growth, 25% for community rewards, and 20% for partnerships. The team and advisors got 11.5%, locked up over four years. That’s designed to prevent dumps and keep incentives aligned.

The Tech Behind the Magic

Newton doesn’t reinvent the wheel - it combines existing tech in a new way:

- Trusted Execution Environments (TEEs): Think of these as secure black boxes. Even if the rest of the network is compromised, the TEE ensures your agent’s logic runs exactly as written, without leaking your data. Newton uses hardware like Phala for this.

- Zero-Knowledge Proofs (ZKPs): These are cryptographic proofs that say, ‘I did this correctly, and here’s proof - but I won’t tell you what I did.’ That’s how zkPermissions work. You set rules like, ‘Only buy if my portfolio drops below 5% ETH,’ and the system proves it followed those rules - without revealing your full strategy.

- Keystore Rollup: Newton runs as a Layer 2 on top of Ethereum. It inherits Ethereum’s security but handles automation faster and cheaper. Finality takes 12-15 seconds, and it can process around 1,200 transactions per second.

- Smart Accounts (ERC-4337): These let you set up custom permissions. Need your agent to only trade during business hours? Set a time lock. Want to cap daily spending at $500? That’s built in.

This combo means your automation isn’t just convenient - it’s cryptographically verifiable. Anyone can check on-chain that every action followed your rules.

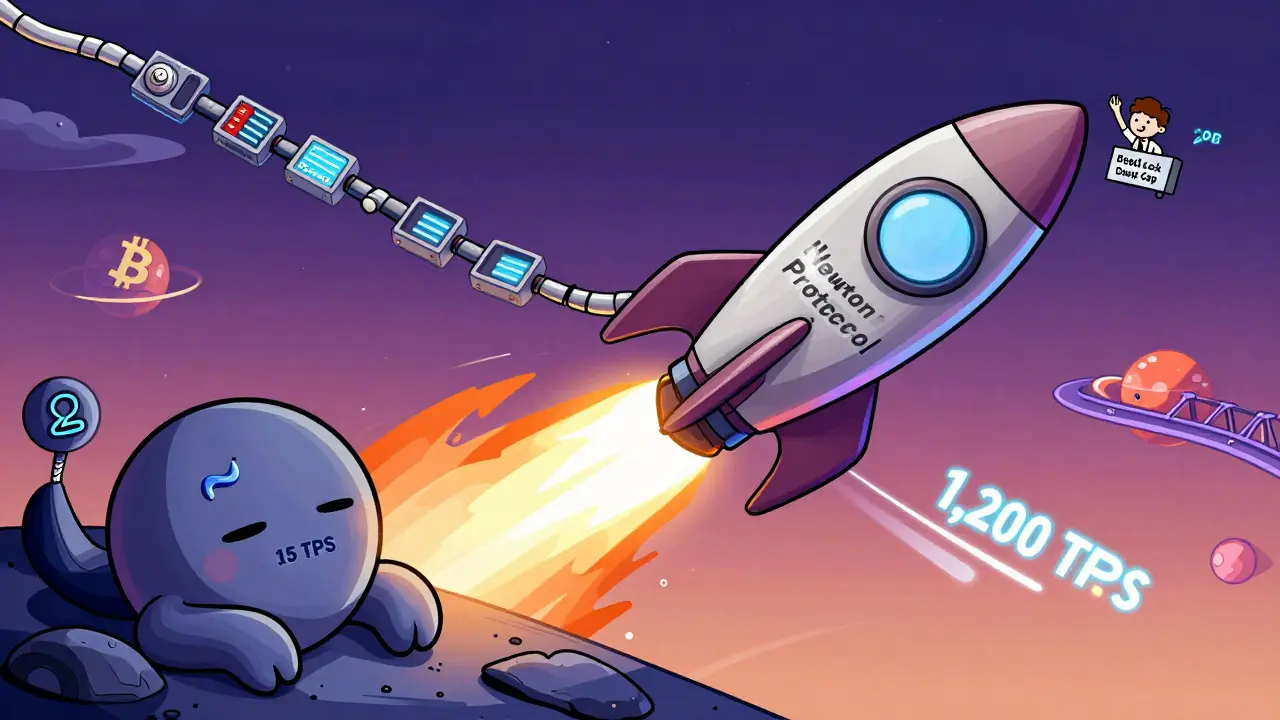

How It Compares to Other Blockchains

Here’s how Newton stacks up against the big players:

| Feature | Newton Protocol | Ethereum | Autonolas |

|---|---|---|---|

| Primary Purpose | Verifiable automation for DeFi | General smart contracts | Decentralized automation |

| Security Model | TEEs + ZKPs + dPoS | PoS consensus | PoS + reputation |

| Privacy of Logic | Yes - agents hide strategies | No - all code is public | Partially |

| Execution Speed | 1,200 TPS | 15-30 TPS | ~500 TPS |

| Cost to Automate | +15-20% over standard TX | Standard gas fees | Similar to Newton |

Ethereum is the foundation. Newton sits on top of it, adding automation with trust. Autonolas tries to do something similar but lacks the ZKPs and TEEs that make Newton’s guarantees stronger. If you care about proving your agent didn’t steal your funds, Newton is the only one offering that level of verification.

Who’s Using It - And Why

Early adopters aren’t just traders. They’re serious DeFi users:

- CryptoAutomator92 on Reddit automated their portfolio across Aave, Uniswap, and Compound. They set a rule: if any asset drifts more than 5%, rebalance. The agent did it - and they never had to touch their wallet.

- Yearn Finance integrated Newton in November 2024 to automate its yield strategies, reducing manual oversight by 70%.

- MakerDAO is testing Newton for automated collateral management - a huge deal if they roll it out.

Adoption is growing fast. In September 2024, only 2,311 unique addresses interacted with Newton. By December 2024, that jumped to 14,852 - a 543% increase in just three months.

Over 120 agent models are already live in the Newton Model Registry. Most are yield optimizers, but you’ll also find arbitrage bots, tax-efficient selling tools, and even insurance triggers.

Downsides and Risks

It’s not perfect. Here’s what you should know:

- Hardware Dependency: Newton relies on TEEs from companies like Phala. If those hardware providers get hacked or go offline, the system could slow down. Some experts worry this creates a single point of failure.

- Higher Costs: Because ZKPs are computationally heavy, using Newton costs 15-20% more than a regular Ethereum transaction. For simple swaps, it’s overkill.

- Staking Lockup: If you’re a validator, you must wait 14 days to unstake. That’s long for some, but it’s intentional - it deters bad actors.

- Steep Learning Curve: Setting up zkPermissions isn’t like clicking a button in MetaMask. You need to understand session keys, gas limits, and permission timeouts. The Newton SDK has 147 pages of docs and 28 code examples. Most users take 2-3 weeks to get comfortable.

Still, for users with over $10,000 in DeFi positions, the tradeoff makes sense. The security is worth the complexity.

What’s Next for Newton Protocol

The roadmap is aggressive - and focused:

- Q2 2025: Connect to Bitcoin using zk-proofs. Imagine automating Bitcoin yield without touching a wrapped asset.

- Q3 2025: Launch the Newton Governance Council. NEWT holders will vote directly on protocol changes through delegated voting.

- Q1 2026: Implement recursive ZK proofs. This could cut verification costs by up to 50%, making automation cheaper than ever.

Market analysts at Binance and Messari predict the verifiable automation space will grow from $1.2 billion in 2024 to $8.7 billion by 2027. Newton already holds an estimated 35% of that niche. If they keep executing, they could become as essential to DeFi as Ethereum is to smart contracts.

Should You Care About NEWT?

If you’re just buying crypto to flip it - NEWT might not be for you. It’s not a meme coin. It’s infrastructure.

But if you:

- Use DeFi daily

- Want your funds to work for you while you’re at work

- Worry about bots stealing your assets

- Believe automation is the future of finance

Then NEWT isn’t just another token. It’s the key to a new kind of financial freedom - one where you’re in control, but never have to lift a finger.

The real question isn’t whether NEWT will go up in price. It’s whether you want to be part of the system that makes automated, trustless finance possible - or just watch from the sidelines.

Is Newton Protocol (NEWT) a good investment?

It’s not a traditional investment - it’s infrastructure. NEWT’s value comes from usage. If more people use Newton to automate DeFi, demand for NEWT rises. It’s not about speculation; it’s about adoption. Early users who understand the tech and stake NEWT are positioning themselves for long-term utility, not short-term gains.

Can I use Newton Protocol without owning NEWT?

No. You need NEWT to pay for transaction fees, access agent models, and stake for security. Even if you’re just using someone else’s automation, you still pay gas in NEWT. You can’t interact with the network without it.

Is Newton Protocol safe?

It’s one of the safest automation systems out there - because of zkPermissions and TEEs. Your agent can’t steal your funds. Every action is provable. But no system is 100% foolproof. Hardware vulnerabilities in TEEs or bugs in smart contracts could pose risks. Always test with small amounts first.

How do I get started with Newton Protocol?

First, get a compatible wallet like MetaMask or Rainbow, and buy some NEWT from exchanges like MEXC or Binance. Then install the Newton SDK (v1.4.3+), connect to the network, and explore the Model Registry. Start with a simple agent - like a rebalancer - and use the permission simulator before deploying real funds. Join their Discord for community help.

Does Newton work on other blockchains besides Ethereum?

Yes. Newton is a Keystore rollup built on Ethereum, but it already supports Arbitrum, Optimism, and Base. The upcoming Q2 2025 update will add Bitcoin via zk-proofs - meaning you could automate Bitcoin-based strategies without wrapping it. Cross-chain is the next big step.

Who created Newton Protocol?

The Magic Newton Foundation, a team of blockchain researchers and engineers focused on verifiable computation. They’ve published their whitepaper, tokenomics, and technical specs publicly on newt.foundation. The team holds 11.5% of NEWT, locked for four years - aligning their incentives with long-term growth.

Final Thoughts

Newton Protocol isn’t trying to replace Ethereum. It’s not even trying to compete with DeFi apps. It’s building the invisible layer underneath them - the part that lets your money act on its own, safely and reliably. NEWT is the token that makes that possible.

Right now, it’s still early. Most people haven’t heard of it. But in two years, if you’re using automated DeFi strategies and you didn’t have to think about it - you might be using Newton without even knowing it. That’s how infrastructure works.

Don’t buy NEWT because you think it’ll pump. Buy it because you believe in a future where your crypto works for you - without you having to watch it every second.

3 Comments

katie gibson

okay but like... who even *needs* this? i’m just here for the memecoins and you’re over here building a financial god complex with zkPermissions and TEEs 😭💸

Ashok Sharma

This is a very good explanation. Newton Protocol helps people to automate their crypto safely. It is not easy to understand, but if you use DeFi, it can help you a lot. Keep learning and stay safe.

Margaret Roberts

TEEs? Phala? Sounds like they’re just outsourcing security to some Silicon Valley corp that’s probably owned by the same people who run the Fed. This is just Wall Street 2.0 with blockchain buzzwords. They’ll rug it when the next bull run ends. I told you so.