Sanctioned Wallet Checker

Check for Sanctioned Crypto Wallets

Enter a cryptocurrency address to verify if it's on the U.S. Treasury's sanctions list. This tool helps identify wallets linked to the $10 billion scam network.

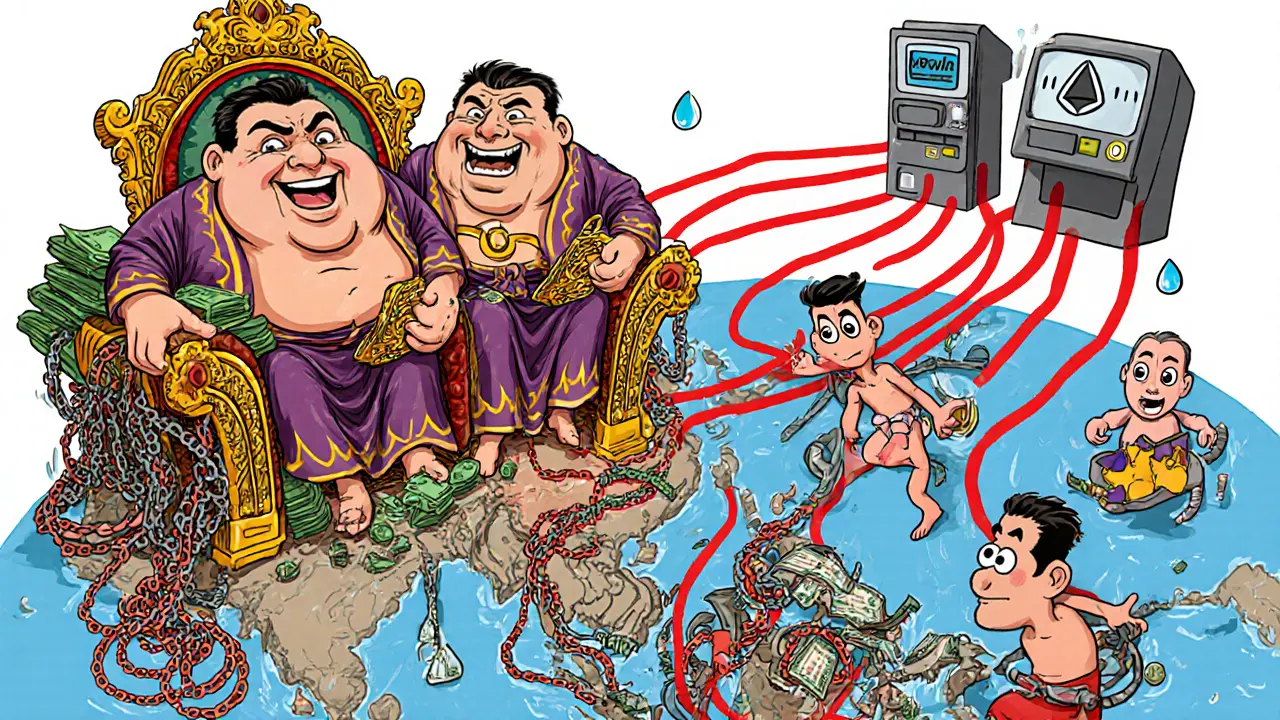

On September 8, 2025, the U.S. Treasury slapped sanctions on nine crypto-related entities operating in Shwe Kokko, Myanmar, and ten more in Cambodia - all tied to a vast network of forced-labor cyber scams that stole over $10 billion from Americans in 2024 alone. This wasn’t just another regulatory move. It was a full-scale takedown of a criminal empire built on digital fraud, human trafficking, and the anonymity of cryptocurrency.

How These Scams Work

These aren’t your average phishing emails or fake ICOs. The operations in Shwe Kokko are industrial-scale fraud factories. People - often lured by fake job postings for customer service or tech roles - are flown into compound-style facilities under false pretenses. Once there, they’re held against their will. Their passports are taken. They’re forced to work 16-hour days, calling thousands of Americans daily with convincing scripts about crypto investments, NFTs, or fake trading platforms. The victims? Americans who think they’re investing in high-return crypto projects. The perpetrators? Often victims themselves - trafficked from Vietnam, China, India, and other parts of Southeast Asia. They’re beaten if they don’t meet quotas. Some are drugged. Others are held in cages. Meanwhile, the money flows into cryptocurrency wallets, layered through mixers and decentralized exchanges to hide its trail. The U.S. Treasury calls it modern slavery. And they’re right.The Karen National Army’s Role

The whole operation runs under the protection of the Karen National Army (KNA), a militant group controlling the Shwe Kokko region along the Thai-Burma border. The KNA isn’t just turning a blind eye - they’re profiting. They collect taxes from the scam compounds, provide armed guards, and block law enforcement from entering. Their leader, Saw Chit Thu, and his two sons, Saw Htoo Eh Moo and Saw Chit Chit, were directly named in the sanctions. The KNA’s connection to Myanmar’s military junta is no secret. The junta, which seized power in 2021, has long tolerated - and sometimes partnered with - criminal networks in exchange for cash and weapons. This isn’t chaos. It’s a business model. The KNA gets funding. The junta gets leverage. The scammers get immunity. And Americans lose billions.Why Crypto? Why Now?

Cryptocurrency is the perfect tool for this kind of crime. It’s fast. It’s borderless. It’s hard to trace - especially when funds are moved through multiple wallets, decentralized exchanges like Uniswap, and privacy coins like Monero. Scammers use fake DeFi platforms, fake NFT marketplaces, and even rigged crypto ATMs to make their schemes look real. In 2024, Americans lost $10 billion to these scams - according to the Treasury’s own estimate. That’s more than the entire annual GDP of some small countries. Chainalysis reported that about 20% of all global crypto fraud in 2024 came from Southeast Asian operations. Shwe Kokko alone accounted for nearly half of that. The U.S. didn’t wait for more victims. The sanctions were aggressive, coordinated, and targeted. They didn’t just freeze bank accounts. They froze everything - digital wallets, domain names, server infrastructure, even the physical buildings where the scams ran.

The Legal Weapons Used

This wasn’t done with one law. The Treasury used four separate executive orders at once:- E.O. 13851 - Targets transnational criminal organizations

- E.O. 13694 - Addresses cyber-enabled financial crimes

- E.O. 13818 - Sanctions human rights abusers

- E.O. 14014 - Punishes those threatening Burma’s stability

Who Got Sanctioned?

The U.S. didn’t go after random wallets. They went after the entire structure:- 9 entities in Shwe Kokko, Myanmar - All linked to KNA-controlled scam compounds

- 10 entities in Cambodia - Financial hubs that laundered crypto from Myanmar

- Saw Chit Thu - KNA leader

- Saw Htoo Eh Moo and Saw Chit Chit - His sons, directly managing operations

- Multiple crypto wallet addresses - Publicly listed by OFAC for tracking

- Three domain names - Used for fake crypto trading platforms

What This Means for Crypto Users

If you’re a regular crypto user, you’re not at risk - unless you’re using unregulated platforms or sending funds to unknown wallets. But here’s the catch: some of these scam wallets look legitimate. They have whitepaper websites, fake audit reports, and even YouTube influencers promoting them. The Treasury released a public list of all sanctioned wallet addresses. Exchanges like Coinbase and Kraken have already blocked transactions to them. But smaller DeFi platforms and peer-to-peer apps? Not all of them are compliant. Bottom line: If you’re sending crypto to a wallet you found on a Telegram group, a Reddit post, or a “guaranteed ROI” ad - stop. Verify. Check the OFAC list. Use tools like Etherscan or Blockchain.com to trace the address history. If it’s ever been flagged, walk away.

What Happens Next?

This is just the beginning. The Treasury said this action “builds on a series of steps taken in the last several months.” That means more are coming. The next targets? Likely Myanmar military officials who profit from these operations. And possibly foreign banks or exchanges that knowingly processed their funds. The U.S. is also working with Thailand, Cambodia, and India to shut down the physical compounds. Joint raids are expected in early 2026. The goal isn’t just to freeze money - it’s to free the people trapped inside. Meanwhile, the $10 billion loss figure isn’t just a number. It’s 100,000 families who lost their life savings. It’s retirees who cashed out their 401(k)s. It’s students who borrowed money to “invest.” And now, the U.S. government is finally treating it like the emergency it is.How to Protect Yourself

Here’s what you can do right now:- Never invest based on a DM or cold call. Legit crypto projects don’t recruit on Telegram.

- Check wallet addresses before sending funds. Use OFAC’s SDN List (searchable via third-party tools like Blockchair or Etherscan).

- Avoid unknown DeFi platforms with no audit history or team transparency.

- Report suspicious activity to the FBI’s IC3 portal - even if you didn’t lose money.

- Use regulated exchanges - they’re required to screen for sanctioned addresses.

Are U.S. citizens allowed to hold cryptocurrency linked to these sanctioned entities?

No. If you hold crypto in a wallet that’s been sanctioned by OFAC, you’re not allowed to trade, transfer, or use those funds. You must freeze them and report the holdings to the Treasury. Even if you didn’t know the wallet was linked to a scam, ignorance isn’t a legal defense. The safest move is to contact a crypto compliance attorney or your exchange for guidance on how to proceed.

Can I still trade with exchanges based in Cambodia or Myanmar?

Technically, yes - but you shouldn’t. Any exchange operating in Cambodia or Myanmar that’s connected to the sanctioned entities is now off-limits to U.S. persons. Most reputable platforms have already blocked access. If you’re using a small, unregulated exchange and it suddenly stops working, it’s likely because it’s been flagged. Don’t try to bypass it. You’re not saving money - you’re risking legal liability.

How do I know if a crypto project is legit and not a scam?

Look for three things: 1) A public, verifiable team with LinkedIn profiles and real names - not pseudonyms. 2) A third-party audit from a known firm like CertiK or SlowMist. 3) Presence on major exchanges like Coinbase or Kraken. If it’s only listed on obscure platforms like MEXC or Gate.io, treat it with extreme caution. Also, check if the project’s wallet has ever been flagged by OFAC. A quick search on Etherscan or SolanaFM can reveal red flags.

Is Bitcoin itself at risk because of these sanctions?

No. Bitcoin and other major cryptocurrencies aren’t banned. The sanctions target specific wallets, companies, and individuals tied to criminal activity - not the technology. The issue isn’t crypto. It’s how criminals abuse it. Just like cash can be used for money laundering, crypto can be too. But banning Bitcoin wouldn’t stop the scams - it would just push them further underground. The U.S. strategy is to clean up the bad actors, not punish the entire ecosystem.

What happens if I accidentally send crypto to a sanctioned wallet?

If you realize you sent funds to a sanctioned address, stop all activity immediately. Do not try to move the funds again. Document the transaction ID and the date. Contact your exchange’s compliance team - they’re required to help you report it. You may also file a voluntary disclosure with OFAC. While penalties can apply, the Treasury often reduces or waives fines if you report the error quickly and cooperate fully. Ignoring it could lead to fines or even criminal charges.

7 Comments

jeff aza

This isn't even close to a takedown-it's a PR stunt with a side of regulatory theater. OFAC slapped 19 entities and called it a day? The real money’s already been laundered through 47 different wallets across 12 jurisdictions. You think freezing a few domain names and wallet addresses stops the flow? Nah. The KNA’s got backup servers in Laos, and the crypto mixers are already rerouting through zk-SNARKs. This is like shutting down a single faucet while the whole dam’s leaking.

And don’t get me started on the ‘humanitarian’ spin. These people aren’t victims-they’re complicit. If you’re coding phishing bots in a compound for 16 hours a day, you’re not some innocent slave-you’re a low-level cog in a machine you knew was evil. You took the job. You got paid in rice and beatings. Now you wanna cry about it? Grow up.

Vijay Kumar

India knows this pain. We lost $3 billion last year to fake crypto apps from Myanmar. Young boys from Bihar, UP, Rajasthan-they get lured with promises of $2000/month remote jobs. Arrive in Thailand, get drugged, wake up in a cage. Their phones are taken. They are forced to scam their own people. I saw a video once-a guy in a yellow shirt, crying, saying ‘I didn’t know it was fake’-and he was 19. This isn’t crime. This is genocide with a blockchain logo.

Sanctions? Good. But what about the Thai police who take bribes? The Cambodian banks that clear the money? The Western influencers who shill these tokens? They’re the real villains. Freeze their assets too.

Vance Ashby

Bro. I just sent $500 to a DeFi pool last week. 😬

Just checked the wallet on Etherscan. It’s clean. Phew. But now I’m paranoid. Every time I see a ‘guaranteed 200% APY’ ad, I just close the tab. I don’t even click. I just… breathe. Crypto’s wild. But this? This is next-level horror.

Thanks for the reminder. I’m switching to Coinbase only from now on. No more random Telegram groups. No more ‘trust me bro’ DMs. I’m done.

😭

Brian Bernfeld

This is the most important thing the U.S. government has done in crypto since the Silk Road takedown.

Let me break it down for the people who still think ‘crypto is just gambling’-this isn’t about speculation. This is about modern slavery. These people are being held in cages. Beaten. Drugged. Forced to lie to their own countrymen while their families back home think they’re working in tech.

The Treasury didn’t just freeze wallets-they froze infrastructure. Buildings. Domains. Servers. That’s not policy. That’s war. And they used four executive orders at once? That’s surgical precision.

If you’re still using unregulated exchanges, you’re not just risking your money-you’re funding torture. This isn’t a ‘crypto risk.’ It’s a moral imperative. Check every wallet. Report every red flag. And if you see someone promoting a ‘guaranteed ROI’ on TikTok? Block them. Report them. Don’t just scroll past.

We can’t save everyone. But we can stop enabling them.

Grace Zelda

Why are we still acting like this is a tech problem? It’s a geopolitical failure. The KNA isn’t some rogue militia-they’re a state-sponsored criminal syndicate with U.S.-made weapons and Thai border complicity. The junta doesn’t just tolerate this-they depend on it. Sanctions won’t fix that. We need boots on the ground. Or at least a coordinated ASEAN task force. Not just a list of wallet addresses.

And why are we only targeting the scammers? What about the Western crypto influencers who promoted these scams? The ones who made millions off fake NFT drops? Where’s their OFAC listing? Hypocrisy is the real scam here.

Sam Daily

Y’all need to stop treating crypto like a casino and start treating it like a minefield.

Imagine your grandma lost her pension because she trusted a guy named ‘CryptoKing99’ on Reddit who sent her a link to a ‘DeFi Oasis’ with a whitepaper that looked like it was written by a ChatGPT bot.

Now imagine that same guy is sitting in a compound in Shwe Kokko, being fed rice and slapped if he doesn’t hit his daily quota.

This isn’t ‘bad actors.’ This is a machine. And we’re all feeding it-with our clicks, our trades, our ignorance.

Check the wallet. Use Coinbase. Ignore Telegram. Report everything. And if you see someone saying ‘it’s too late to stop’-tell them to go look up the names on that OFAC list. Real people. Real cages. Real pain.

Don’t be the reason it keeps going.

❤️

Kristi Malicsi

I used to think crypto was the future. Now I think it’s just the latest way the rich get richer and the desperate get crushed. The U.S. sanctions are a drop in the ocean. But at least they’re a drop. Maybe someone’s watching. Maybe someone’s learning. Maybe next time, it won’t take $10 billion lost before someone cares.

Just… check the wallet. Please.